J

J............

Hi everyone,

sorry about this question, i have searched and read other threads but am still slightly uneasy as i havent bought a new vehicle on pcp before.

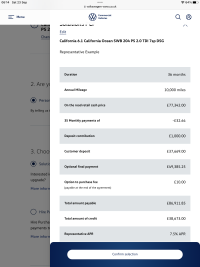

We are looking at a cali on PCP approx 7%. For the purposes of this the cali is approx £65k. We were looking it a large deposit, circa £30k and around £250 per month instalments with a balloon around £35k.

We have the ability now to potentially withdraw from the agreement and pay in full if it makes sense. But, I had a couple of queries around this.

Withdraw and pay the full price of the cali within 14 days appears the best option in terms of lowest cost to us.

But, I had seen talk of paying a month or two of instalments to be covered under consumer credit act should something go wrong with the vehicle, then requesting a settlement figure, but I wasn't sure what this would cost us.

There would be the deposit up front, plus 2 instalments (£500). But what would the settlement likely be? The balloon plus a little bit of interest for two months or would this be part of the £500 paid up already?

Any thoughts on if it is worth paying a month or two to have this potential additional layer of protection?

thanks in advance for any advice, really looking forward to owning a cali but the whole finance thing has me unsure

sorry about this question, i have searched and read other threads but am still slightly uneasy as i havent bought a new vehicle on pcp before.

We are looking at a cali on PCP approx 7%. For the purposes of this the cali is approx £65k. We were looking it a large deposit, circa £30k and around £250 per month instalments with a balloon around £35k.

We have the ability now to potentially withdraw from the agreement and pay in full if it makes sense. But, I had a couple of queries around this.

Withdraw and pay the full price of the cali within 14 days appears the best option in terms of lowest cost to us.

But, I had seen talk of paying a month or two of instalments to be covered under consumer credit act should something go wrong with the vehicle, then requesting a settlement figure, but I wasn't sure what this would cost us.

There would be the deposit up front, plus 2 instalments (£500). But what would the settlement likely be? The balloon plus a little bit of interest for two months or would this be part of the £500 paid up already?

Any thoughts on if it is worth paying a month or two to have this potential additional layer of protection?

thanks in advance for any advice, really looking forward to owning a cali but the whole finance thing has me unsure