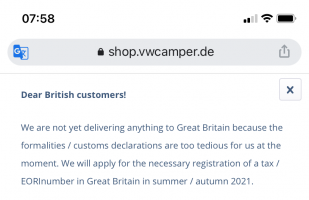

That's not really the point is it? The motoring aftermarket in the UK is highly interdependent with continental Europe. This thread is about campervan accessories but there are similar post-transition issues, hassles and costs facing a lot of other specialist automotive sectors.

One example is motorsport. The UK's 'motorsport valley' alone (the cluster of businesses in the south Midlands and Oxfordshire) employs thousands in highly skilled jobs and contributes billions to the UK economy. It is highly dependent on European partners and customers, and needs to be highly responsive when parts or sub-assemblies need to be moved, often at short notice.

And even complete cars: eg you now have to pay several hundred pounds to get an international customs carnet to move a vehicle across the channel for a race or rally. Not an issue for Red Bull or Mercedes but significant for the lower levels of the sport that underpin the elite levels.

Having to get a visa for an engineer to travel for a short assignment in Toulouse or Munich is yet another administrative hassle that no-one needs.

None of these things are individually crucial to the sector but they add up to a whole bunch of hassles, costs and obstacles that didn't exist before 31 Dec in dealing with customers and suppliers. Saying that it's still no harder than doing business with Tunisia or Turkey or wherever is completely irrelevant isn't it.