WelshGas

Retired after 42 yrs and enjoying Life.

Super Poster

Lifetime VIP Member

Yes.So is my understanding of this that any goods imported into the UK are essentially VAT free but must have duty paid on arrival?

Yes.So is my understanding of this that any goods imported into the UK are essentially VAT free but must have duty paid on arrival?

I would have thought the vendor, they have priced the goods incorrectly if you have had to pay VAT on receipt as the price shown should have been ex VAT in the first place.Ok so in my case I have bough an item from a UK website at a price shown in £ and inclusive of VAT.

The vendor then imports my item to me from Germany and I incur customs duty on top.

Next question. From who do I claim back the VAT/import duty as I’ve effectively paid twice?

Ok so in my case I have bough an item from a UK website at a price shown in £ and inclusive of VAT.

The vendor then imports my item to me from Germany and I incur customs duty on top.

Next question. From who do I claim back the VAT/import duty as I’ve effectively paid twice?

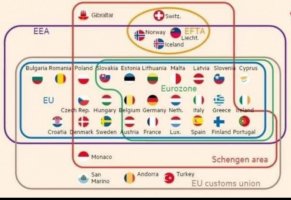

Very trueHere is the nub of the problem

View attachment 72257

Sorry, not disliking your post and appreciate your just passing on the message. Just disliking the Brexit/Covid outcomes. No offence intended.@GrumpyGranddad why have you disliked my post i'm only passing on a message i don't set the prices.

@Amarillo i think the real issue is courier companies now charging an admin fee.

What I can’t get an answer for, is what is the fee...?

VAT will always be required. So nothing new there.

But it seems an additional fee, plucked out of thin air by couriers taking advantage of the situation.

Well you'd then have to declare the goods at entry to the UK and pay the necessary duties and VAT. It doesn't matter if it comes over on a courier's van or in the back of your van, it's still an import.But if huge chunks of money are due on expensive items like treadmills, what is to stop someone ordering for delivery to a mailbox in Calais and collecting it in person if duty free allowance or non-UK VAT will permit.

Any item purchased in the EU would have EU VAT added. You would request a VAT receipt and at the port of exit there would be a designated place where you would present your receipt and passport and be refunded the EU VAT and then on arrival at UK Customs declare the item and depending on any personal Duty Free allowance pay the required Customs Duty/UK Vat.If it is as simple as that, market forces will eventually take over. People won’t order without knowing the admin fee in advance, and courier companies won’t deliver unless they can be fairly sure they can deliver successfully.

But if huge chunks of money are due on expensive items like treadmills, what is to stop someone ordering for delivery to a mailbox in Calais and collecting it in person if duty free allowance or non-UK VAT will permit.

I think that may take a while actually, at least when buying from smaller specialist businesses on the continent.If it is as simple as that, market forces will eventually take over. People won’t order without knowing the admin fee in advance, and courier companies won’t deliver unless they can be fairly sure they can deliver successfully.

It is very early days, no one was certain what the deal would be until Christmas eve. There have been a number of side agreements on other things since then so anything is possible in the future.I think that may take a while actually, at least when buying from smaller specialist businesses on the continent.

MANY(!) years ago I ran a UK-based business that supplied customers mostly within the UK/EU but a small proportion outside. Smallish scale but still shipping several thousand consignments a week. When negotiating our courier contracts we were almost 100% focused on lowest average cost (the price the customer was charged for shipping was not determined by the cost to us - shipping was a profit line). We wanted to deal with as few couriers as possible, just one ideally.

Our non-EU customers often complained that they'd been hit with admin, clearance, duty and other charges at their end. They usually blamed us - fair enough but it frankly wasn't worthwhile for us to try to sort it out, we just charged what we charged and if some of the non-EU customers went elsewhere that was that. There's no point jumping through hoops to retain customers that aren't profitable to service.

An EU-based small e-commerce business is going to contract with the courier that gives it the best deal on the bulk of its shipments, rather than the one that charges the lowest admin rates on occasional shipments ex-EU.

But anyway we'll have to wait and see.

And just for the extra kick in the nads, the VAT goes on top of the whole lot. As for the couriers taking the wee wee, can you blame them? It's the same as Eurotunnel charging for pets!@Amarillo i think the real issue is courier companies now charging an admin fee.

What I can’t get an answer for, is what is the fee...?

VAT will always be required. So nothing new there.

But it seems an additional fee, plucked out of thin air by couriers taking advantage of the situation.

YesAnd just for the extra kick in the nads, the VAT goes on top of the whole lot. As for the couriers taking the wee wee, can you blame them? It's the same as Eurotunnel charging for pets!

Referendum anyone?

Blimey that first beer went down quick.Referendum anyone?

In theory if import levels remain the same which is unlikely due to Customs & handling aggro, delays and additional carriage aggro, that is why regardless of politics Customs Unions boost trade.Is the following correct?

UK imports more from 'europe' than we export to them.

Say we import £10 for every £8 we export to keep the maths simple (before vat values).

Pre Brexit, Europe collected 20% vat (£2) on the £10 we imported.

Pre Brexit, UK collected 20% vat (£1.60) on the £8 we exported.

Post Brexit, is the situation reversed? For every £1.60 we would have collected, do we now collect £2?

Assuming that's right and the trade imbalance remains the same, that's quite a tidy bonus for Rishi Sunack to collect?

No political points aiming to be scored (before Amarillo reports the post). I'm just checking my logic, and may have made a fool of myself. I blame French wine.

Total world trade in billions of euros by the EU, amazing hey.In theory if import levels remain the same which is unlikely due to Customs & handling aggro, delays and additional carriage aggro, that is why regardless of politics Customs Unions boost trade.

| Rank | Country/district | Total trade |

|---|---|---|

| 1 | United States | 615 |

| 2 | China | 559 |

| 3 | United Kingdom | 511 |

The VW California Club is the worlds largest resource for all owners and enthusiasts of VW California campervans.