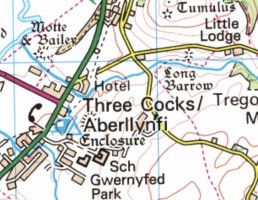

Lets face it those houses you really like are a bit too exposed to the wind to expect chickens to be happy there. There is a reason why so little is in those back gardens. The one of a different design that you have in mind as a possible fifth is good for chickens but I doubt you really want it as its position is compromised. So that leaves 4, one of which is unlikely to be available anytime soon, that one next to the possible fifth. Then the one at the end of the row, I would rule out as both front and rear gardens are too small and there may be an issue on privacy as so many people keep their smelly boats right next door. Maybe privacy wont matter to you though. People walking the path at the bottom of the garden but on the other hand that path is very handy leading to sailing clubs in either direction.

So that leaves just 2 properties ideal for you. The risks of you not landing one of these are not financial. They are ill health and/or death and certainly you not being in a position to proceed immediately if an opportunity arises. As this appears to be so important to you, I think you should talk to the owners of those properties.

Hey! I’m really impressed that you have worked out the exact location, though I’m unsure you have the possible fifth correct. The one I’m thinking of has two garages and a first floor conservatory.

Of the four, the one next to the dinghy park and the one next to that have small gardens. But hey- who needs a big garden when you have 3700 hectares of biological and geological Site of Special Scientific Interest literally at the end of the garden, part of a even bigger area of outstanding natural beauty.

I think we can move quickly.

One of the things I have learn from this thread is that we can buy without selling our main home, and get the 3% stamp duty surcharge refunded if we sell our current home within 3 years of buying an additional home.

So the aim can still be to have a mortgage free retirement, and buy without initially selling.

House #4 sold last summer for £930,000. If we bought that as a second home stamp duty would be nearly £65,000 so not an insignificant sum. £28,000 would be refunded if we sold our main home within three years.

So here are some indicative figures of how it could work.

60% mortgage current home for £405,000 (value estimate £675,000)

60% mortgage on new home for £558,000 (value estimate £930,000)

Total borrowing £963,000

Total purchase £995,000 inc SD

£32,000 from savings.

Sell current home £703,000

Borrowing reduced to £260,000

Sell a rental property for £285,000, this could be done before purchase.

So to be ready to go, all we need is an agreement in principle for the two new mortgages. This can be arranged in days.

Early redemption charges on the two new mortgages need watching, but if taken out with a two year fixed rate, after those two years there should not be a early redemption penalty, just the standard charge of ~£30 IIRC.