You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

clarinetbcn

T5.1 Beach 140

Top Poster

Lifetime VIP Member

We all noticed it, just hoped that ignoring it would make it stop.Okay in that case my mistake, sorry. My general point was that post #10 didn't get a reaction from anyone, other than from you.

soulstyledevon

Kennycalifornia

Super Poster

VIP Member

- Messages

- 6,518

- Vehicle

- Cali now sold

Wow, this blew up...

I don’t mind the non VW van posts.

Unlike other forums. I find subjects outside of the usual van chat, interesting and informative.

We have a great spectrum of contributors on this forum.

Second home ownership, is the devils work...

Agree/Disagree, your choice.

However @Amarillo I’m interested to follow this post to hear how you are financing the move.

I am considering ways to release equity from my property to invest in some other avenues I want to explore.

So keep posting, it’s very informative

I don’t mind the non VW van posts.

Unlike other forums. I find subjects outside of the usual van chat, interesting and informative.

We have a great spectrum of contributors on this forum.

Second home ownership, is the devils work...

Agree/Disagree, your choice.

However @Amarillo I’m interested to follow this post to hear how you are financing the move.

I am considering ways to release equity from my property to invest in some other avenues I want to explore.

So keep posting, it’s very informative

V

vwsween

Its very easy to work out location.Hey! I’m really impressed that you have worked out the exact location, though I’m unsure you have the possible fifth correct. The one I’m thinking of has two garages and a first floor conservatory.

Of the four, the one next to the dinghy park and the one next to that have small gardens. But hey- who needs a big garden when you have 3700 hectares of biological and geological Site of Special Scientific Interest literally at the end of the garden, part of a even bigger area of outstanding natural beauty.

I think we can move quickly.

One of the things I have learn from this thread is that we can buy without selling our main home, and get the 3% stamp duty surcharge refunded if we sell our current home within 3 years of buying an additional home.

So the aim can still be to have a mortgage free retirement, and buy without initially selling.

House #4 sold last summer for £930,000. If we bought that as a second home stamp duty would be nearly £65,000 so not an insignificant sum. £28,000 would be refunded if we sold our main home within three years.

So here are some indicative figures of how it could work.

60% mortgage current home for £405,000 (value estimate £675,000)

60% mortgage on new home for £558,000 (value estimate £930,000)

Total borrowing £963,000

Total purchase £995,000 inc SD

£32,000 from savings.

Sell current home £703,000

Borrowing reduced to £260,000

Sell a rental property for £285,000, this could be done before purchase.

So to be ready to go, all we need is an agreement in principle for the two new mortgages. This can be arranged in days.

Early redemption charges on the two new mortgages need watching, but if taken out with a two year fixed rate, after those two years there should not be a early redemption penalty, just the standard charge of ~£30 IIRC.

And there you go again fully concentrating on the finance rather than the issues. Hope it works out for you.

jimmywease

VIP Member

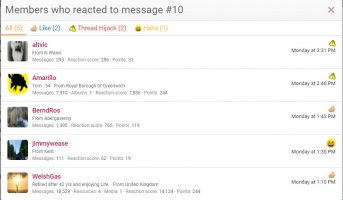

For the record, my ‘haha’ was because post#10 made me laugh, not because I understood it to be some kind of personal attack, which I still don’t see.Sorry to be a pedant, but there were five reactions including mine. No one responded, if that is what you meant.

View attachment 78790

Velma's Dad

Super Poster

VIP Member

Okay sounds like this is an itch that some folks want to scratch, so...Second home ownership, is the devils work...

Agree/Disagree, your choice.

Firstly I'd have thought there's a huge difference (morally, if you wish) between people who own more than one properties for their own use, and people owning property that they let out, either long term or as short lets including for holiday lets.

I personally can readily see the basis of an objection to the "second home" ownership, although am in that situation myself. The main argument against will be (presumably) that it pushes up house prices and can price local people out of the market. On the other hand, second homes are fully taxed so the owners will be contributing to services they don't consume, education being one.

I fail to see the issue with owning property to rent out, assuming we believe there should be a private rental sector alongside owner-occupation and social housing. Most European countries have a far higher proportion of rental versus ownership than is the case in the UK, and it seems to work fine for them as far as I can see.

Starting whistle blown. No spitting or gouging.

Velma's Dad

Super Poster

VIP Member

Sin bin, ten minutes.Isn’t objecting to second home ownership just objecting to people who have more money than you do.

(Gets beer)

Wesel

For me this forum is about VW California, and everything related to it, directly or indirectly: the vehicle itself, the accessories, the trips, the impacts of covid or political changes on our trips, the technical aspects , etc.

Some had to make sacrifices to buy their van, while others did not.

Some have to save on everything, others don't.

We are all different, from the point of view of our income, properties ...

I do not express an opinion on the person, nor his situation, nor his concerns. But I believe that these last aspects do not out of place here and I understand that someone who flaunts his success and shows here looking for even more may shock some.

Cordially.

Some had to make sacrifices to buy their van, while others did not.

Some have to save on everything, others don't.

We are all different, from the point of view of our income, properties ...

I do not express an opinion on the person, nor his situation, nor his concerns. But I believe that these last aspects do not out of place here and I understand that someone who flaunts his success and shows here looking for even more may shock some.

Cordially.

HowieDog

Lifetime VIP Member

Can be a good strategy if you have sufficient capacity for loss, which given that Amarilo does not rely on a single tenant appears to be the case.Hello Tom

I am a Chartered Accountant but yet would strongly advise that you consult an IFA which my wife and I have done on our pension, re-mortgaging plans and property. Best of all if you can is to find a qualified ie Chartered IFA as most are not.

In general terms my IFA advises for continuing with a mortgage, especially fixed deals, as you can - if well managed - earn much more in a balanced market portfolio than it will cost you with a great mortgage deal. Fixed interest-only of course ensures no rate rise exposure and along with that, I used an associate of my IFA who is a qualified mortgage broker - they are worth their weight in gold.

Happy to refer you if you want a quote or a chat....

For us to go mortage free at a time of such very low rates is not wise and savings efficient, but I know it is what most people strive for - for me it is heart rather than head thinking

Whatever you do, strongly recommend you get good independent savings/mortage advice

David

larrylamb

Super Poster

VIP Member

This thread is posted in the "off topic" section. If the subject matter is not for you, it's easy to just ignore. I'm all for anything and everything being discussed in the non Cali section. As for flaunting wealth, I don't think it's about that, there are lots of people in the forum , wealthy or not who have made valid points and ideas relevant to the thread. I for one have learnt from it.For me this forum is about VW California, and everything related to it, directly or indirectly: the vehicle itself, the accessories, the trips, the impacts of covid or political changes on our trips, the technical aspects , etc.

Some had to make sacrifices to buy their van, while others did not.

Some have to save on everything, others don't.

We are all different, from the point of view of our income, properties ...

I do not express an opinion on the person, nor his situation, nor his concerns. But I believe that these last aspects do not out of place here and I understand that someone who flaunts his success and shows here looking for even more may shock some.

Cordially.

Amarillo

Tom

Super Poster

VIP Member

Its very easy to work out location.

And there you go again fully concentrating on the finance rather than the issues. Hope it works out for you.

Some of the issues I have little or no control over, such as will one become available before September 2025. But I do have a plan if one doesn’t.

The question for me was always about the financial risk involved in holding onto our current home and use it as a buy to let. And I think I have answered that with an option I hadn’t really considered.

The risk would be reduced by keeping it for a short period of time (<3 years), if that was needed to move quickly with a purchase.

V

vwsween

Yes I know your main focus has been on finance but in terms of reaching your goal of buying one of those houses, finance isn't your main problem. You can pay money to get first refusal at market price if they decide to sell. That knowledge of a buyer ready and able may even encourage a sale sooner?

Amarillo

Tom

Super Poster

VIP Member

Yes I know your main focus has been on finance but in terms of reaching your goal of buying one of those houses, finance isn't your main problem. You can pay money to get first refusal at market price if they decide to sell. That knowledge of a buyer ready and able may even encourage a sale sooner?

Yes - but there are several other issues if we act now. Neither Clare nor I are yet 55, so unable to get a RIO mortgage. The closer to Sept 2025 we move, the better for us.

Having said that, I know that the householder of one of our target houses has had a bad stroke and has been hospitalised for 3 months. Will their partner wish to remain alone in the house if their other half cannot return home?

I do already know all four (five) householders reasonably well.

willwander

Top Poster

VIP Member

This forum is about making money for the owners and driving sales to the ‘club’ shop.For me this forum is about VW California, and everything related to it, directly or indirectly: the vehicle itself, the accessories, the trips, the impacts of covid or political changes on our trips, the technical aspects , etc.

Some had to make sacrifices to buy their van, while others did not.

Some have to save on everything, others don't.

We are all different, from the point of view of our income, properties ...

I do not express an opinion on the person, nor his situation, nor his concerns. But I believe that these last aspects do not out of place here and I understand that someone who flaunts his success and shows here looking for even more may shock some.

Cordially.

soulstyledevon

Kennycalifornia

Super Poster

VIP Member

- Messages

- 6,518

- Vehicle

- Cali now sold

Okay sounds like this is an itch that some folks want to scratch, so...

Firstly I'd have thought there's a huge difference (morally, if you wish) between people who own more than one properties for their own use, and people owning property that they let out, either long term or as short lets including for holiday lets.

I personally can readily see the basis of an objection to the "second home" ownership, although am in that situation myself. The main argument against will be (presumably) that it pushes up house prices and can price local people out of the market. On the other hand, second homes are fully taxed so the owners will be contributing to services they don't consume, education being one.

I fail to see the issue with owning property to rent out, assuming we believe there should be a private rental sector alongside owner-occupation and social housing. Most European countries have a far higher proportion of rental versus ownership than is the case in the UK, and it seems to work fine for them as far as I can see.

Starting whistle blown. No spitting or gouging.

We probably need a new thread before some hits the Thread Hijack button.

Sorry for the diversion Amarillo.

However

Are your private rents cheaper than a typical family/couple who would mortgage the property...?

Probably not.

If we had a fair system in this country I could get on board with second home ownership. But it’s bloated with private landlords, with unregulated rents and zero to none build quality standards.

The housing crisis in this country is a National scandal produced from big building companies limiting supply to inflate prices.

Land sold to major building firms who sit on and release/build at such small quantities they never really fill the void, hence keep pricing at ridiculously high levels.

This requires action by councils and the government to force building on a massive scale and produce more council owned properties available to everyone in society...

I actually bought my second property at 20 years old, with a view to rent. However, it wasn’t something that sat right with me and I renovated the property and sold on.

To be honest I’ve done alright out of property over the years, but I draw the line at buying to rent.

westfalia

Its a toxic thread, i'm on the fence.. so i won't comment

@califate does have a point though.

Shouting out that someone is a troll is not necessary unless they are

first time posters or similar.

It puts people off posting if you can't comment or your comment

gets a barrage of abuse.

@califate does have a point though.

Shouting out that someone is a troll is not necessary unless they are

first time posters or similar.

It puts people off posting if you can't comment or your comment

gets a barrage of abuse.

Amarillo

Tom

Super Poster

VIP Member

We probably need a new thread before some hits the Thread Hijack button.

Sorry for the diversion Amarillo.

However

Are your private rents cheaper than a typical family/couple who would mortgage the property...?

Probably not.

My profit is from having high equity in the property and thus qualifying from low or ultra low interest rates.

A family paying 5% interest on the entire value (£285,000) of one of my flats would be paying more than the £1,175pm rent.

But I also have to cover void periods, redecoration costs, service charge, buildings insurance, and maintenance. Then, of course, I have the risk of tenants who can’t or won’t pay their rent.

Perfectos

Super Poster

Lifetime VIP Member

Califate is not a first time poster.Its a toxic thread, i'm on the fence.. so i won't comment

@califate does have a point though.

Shouting out that someone is a troll is not necessary unless they are

first time posters or similar.

It puts people off posting if you can't comment or your comment

gets a barrage of abuse.

califate deliberately posted to get a rise, AKA a troller , in such that it is toxic, he / she did not engage in the open discussion and chose to be deliberately & negative post to the op based on their particular views (whatever political views) and the OPs good financial planning over many many years.

iMO, its not a toxic thread, it’s a thread that prompts thoughts that some have more fiscal awareness than others, Through hard graft and taking risk other would have shide away from!

Last edited:

Velma's Dad

Super Poster

VIP Member

I think that shows why net rental returns after finance costs from private domestic letting are usually very low. They used to be tax efficient but less so now. That ignores capital appreciation due to house price rises which is where most of the 'profit' comes from in buy-to-let. That is of course due to underlying supply constraints in house building, which has been ascribed to the constrictive planning system although that's arguable. But it's still risky if you need access to your capital when prices are depressed, and selling out isn't ever going to be instant. From that perspective the returns on buy-to-let as an illiquid asset class are not very attractive generally (IMO) compared to other highly liquid (if volatile) asset classes such as diversified global equities.My profit is from having high equity in the property and thus qualifying from low or ultra low interest rates.

A family paying 5% interest on the entire value (£285,000) of one of my flats would be paying more than the £1,175pm rent.

But I also have to cover void periods, redecoration costs, service charge, buildings insurance, and maintenance. Then, of course, I have the risk of tenants who can’t or won’t pay their rent.

Amarillo

Tom

Super Poster

VIP Member

I think that shows why net rental returns after finance costs from private domestic letting are usually very low. They used to be tax efficient but less so now. That ignores capital appreciation due to house price rises which is where most of the 'profit' comes from in buy-to-let. That is of course due to underlying supply constraints in house building, which has been ascribed to the constrictive planning system although that's arguable. But it's still risky if you need access to your capital when prices are depressed, and selling out isn't ever going to be instant. From that perspective the returns on buy-to-let as an illiquid asset class are not very attractive generally (IMO) compared to other highly liquid (if volatile) asset classes such as diversified global equities.

I expect we will be getting out of the private rental business altogether after we move, and as and when tenants move out.

We have considered setting up a limited company for the business to pass down as a legacy to our boys, but I’m not so sure now. We have also considered gifting them a flat each when they leave school and start university as a tax efficient way to help pay for their education, but something doesn’t sit right with us there.

G

Ghilliechief

Sometimes less is more.In 1990 I bought my first home: £57,000 with £17,000 deposit and £40,000 mortgage.

By 2005 the mortgage had been repaid, and I had 6 years of glorious mortgage free living.

In 2011 Clare and I bought a house together. £348,000, with £120,000 from a buy-to-let mortgage on my first home and a £228,000 mortgage on the house we bought. Clare had her own flat which she also rented out. We both worked full time and we each had rental incomes.

Rental income on my old flat and rental income from Clare's flat more or less covered both mortgages.

We are now in the fortunate position where we might go mortgage free again in three or four years time.

Can we risk repeating the trick to buy our dream home for retirement?

Mortgage our current home with a 60% buy-to-let loan.

Use that 60% as a 40% deposit on a Retirement Interest Only (RIO) mortgage for our dream seafront retreat.

For illustration: if our current home is valued at £700,000 we could borrow £420,000, and use that as a deposit on a home worth up to £1,050,000 by taking out a 60% RIO mortgage of £630,000.

Or is this too much of a risk at our stage of life?

Borrowing a total of £1,050,000 at 3% would incur interest payments of £2,625 per month, broadly in line with our expected *gross* rental income from our current family home.

But interest rates are at a record low - the only way is up. 6% would double the interest payments; 9% would triple them; 12% would quadruple them; and 15% (I was paying 15.75% in 1990) would quintuple them to £13,125 per month. We can mitigate the risk for a limited period with a fixed rate mortgage, and have the escape route of selling both our current home and my original flat to repay both mortgages in full at current estimated values.

So the risk would come from high interest rates *and* falling house prices. Is this a risk too far for a dream home for retirement? I have about four years to work this out. There are four substantially identical houses, all in a row, that we have our eyes on.

Be content with what u have, ur doing better than many

Scottedog

Think your on the wrong forumIn 1990 I bought my first home: £57,000 with £17,000 deposit and £40,000 mortgage.

By 2005 the mortgage had been repaid, and I had 6 years of glorious mortgage free living.

In 2011 Clare and I bought a house together. £348,000, with £120,000 from a buy-to-let mortgage on my first home and a £228,000 mortgage on the house we bought. Clare had her own flat which she also rented out. We both worked full time and we each had rental incomes.

Rental income on my old flat and rental income from Clare's flat more or less covered both mortgages.

We are now in the fortunate position where we might go mortgage free again in three or four years time.

Can we risk repeating the trick to buy our dream home for retirement?

Mortgage our current home with a 60% buy-to-let loan.

Use that 60% as a 40% deposit on a Retirement Interest Only (RIO) mortgage for our dream seafront retreat.

For illustration: if our current home is valued at £700,000 we could borrow £420,000, and use that as a deposit on a home worth up to £1,050,000 by taking out a 60% RIO mortgage of £630,000.

Or is this too much of a risk at our stage of life?

Borrowing a total of £1,050,000 at 3% would incur interest payments of £2,625 per month, broadly in line with our expected *gross* rental income from our current family home.

But interest rates are at a record low - the only way is up. 6% would double the interest payments; 9% would triple them; 12% would quadruple them; and 15% (I was paying 15.75% in 1990) would quintuple them to £13,125 per month. We can mitigate the risk for a limited period with a fixed rate mortgage, and have the escape route of selling both our current home and my original flat to repay both mortgages in full at current estimated values.

So the risk would come from high interest rates *and* falling house prices. Is this a risk too far for a dream home for retirement? I have about four years to work this out. There are four substantially identical houses, all in a row, that we have our eyes on.

Similar threads

- Replies

- 38

- Views

- 7K

- Replies

- 11

- Views

- 2K

A

- Replies

- 7

- Views

- 1K

A

About us

The VW California Club is the worlds largest resource for all owners and enthusiasts of VW California campervans.