You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Jabberwocky

Forever young (ish!)

Super Poster

Lifetime VIP Member

Have you looked here?

www.gov.uk

www.gov.uk

Vehicle tax rates

Tables showing the rates for vehicle tax for different types of vehicle.

B J G

Super Poster

Lifetime VIP Member

No such category as a Campervan. There was/is Motor Caravan but California no longer qualifies in this category and now classed as an MPV.

Motor Homes I believe are now being subjected to the over £40K tax which is pushing them up. Californias have been subject to this since introduced in April 2017.

Motor Homes I believe are now being subjected to the over £40K tax which is pushing them up. Californias have been subject to this since introduced in April 2017.

Jabberwocky

Forever young (ish!)

Super Poster

Lifetime VIP Member

westfalia

Not sure if you can open this--

It was in the sunday times yesterday.

www.thetimes.co.uk

www.thetimes.co.uk

It was in the sunday times yesterday.

Tax hike ‘means the end of the road for camper vans’

A tax rise that adds nearly £1,900 on to the price of a new camper van should be reversed because it threatens the future production of such vehicles, a group of MPs have argued.Fifty-five MPs joined campaigners last week in calling for Boris Johnson to rethink the 705% increase in the cost of a bu

pjm-84

Super Poster

VIP Member

- Messages

- 2,528

- Vehicle

- T5 SE 180

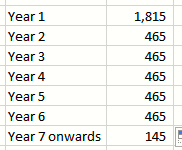

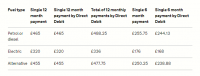

My interpretation for a van (MyCali) with CO2 emissions of between 191 and 225g/km and cost (the published price before any discounts) more than £40k. This is for new registrations since April 2017.

View attachment 55168

145 for year 6 onwards

Jabberwocky

Forever young (ish!)

Super Poster

Lifetime VIP Member

pjm-84

Super Poster

VIP Member

- Messages

- 2,528

- Vehicle

- T5 SE 180

Yes, you're correct. Always known as 5years but checking again it states after first year licence.So the reality is its not until year 7 that you pay the lower VED

Jabberwocky

Forever young (ish!)

Super Poster

Lifetime VIP Member

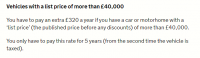

Sorry but it's after 6 years. 1 + the emissions tax in year 1, then 5 + the std rate of £145 + price list tax of £320 for the next five years, by which time it will be 6 years of tax and thus the 7th year before it goes to the std rate of £145.

Jabberwocky

Forever young (ish!)

Super Poster

Lifetime VIP Member

Yes, old news but still confusing/unsettling for some.Isn’t this all old news? It all seems to have been stirred up with a feature in The Times, but this has been the situation since 2017.

Bellcrew

Top Poster

VIP Member

Up to September 2019 whilst California's had been taxed as if they were cars, most if not all conversions/motorhomes avoided the enhanced road fund tax/£40000+ supertax by dint of the manufacturers using a loophole in the regulations.Isn’t this all old news? It all seems to have been stirred up with a feature in The Times, but this has been the situation since 2017.

If they did not notify the tax authorities of the original vans CO2 emissions when registering the were just taxed as private goods vehicles.

Unfortunately someone at the inland revenue noticed and decided to insist that all these conversions would be assumed to be private passenger vehicles and subject them to the same taxation regime that expensive cars had to pay.

Calimili

Is that for the big white motorhomes as well?Up to September 2019 whilst California's had been taxed as if they were cars, most if not all conversions/motorhomes avoided the enhanced road fund tax/£40000+ supertax by dint of the manufacturers using a loophole in the regulations.

If they did not notify the tax authorities of the original vans CO2 emissions when registering the were just taxed as private goods vehicles.

Unfortunately someone at the inland revenue noticed and decided to insist that all these conversions would be assumed to be private passenger vehicles and subject them to the same taxation regime that expensive cars had to pay.

Calimili

That‘s moronic sorry. So you get a bunch of people that like to go camping most likely in the UK and pay local fuel, camping fees, restaurant and bars. It all stays in the country, including the taxes on all the above. But because the motorhome due to weight and size pollutes a bit more than a car the govt thinks they should get $(rewd. Would we be then better off if such bunch of people would then instead jump on a way more polluting flight overseas and spend their money there?

Sorry for the rant

Sorry for the rant

WelshGas

Retired after 42 yrs and enjoying Life.

Super Poster

Lifetime VIP Member

Not quit correct. ALL cars, and the California is registered as a M1 Diesel Car in the U.K., that cost over £40,000 are taxed at this special rate for 6 years.That‘s moronic sorry. So you get a bunch of people that like to go camping most likely in the UK and pay local fuel, camping fees, restaurant and bars. It all stays in the country, including the taxes on all the above. But because the motorhome due to weight and size pollutes a bit more than a car the govt thinks they should get $(rewd. Would we be then better off if such bunch of people would then instead jump on a way more polluting flight overseas and spend their money there?

Sorry for the rant

Bellcrew

Top Poster

VIP Member

Yes, lots of of these big whites were preregistered before September and a number of dealers are absorbing the increased on the road charges for the moment. Any ones guess how this will play out.Is that for the big white motorhomes as well?

Calimili

Well it‘s difficult to understand the rationale of treating a Campervan the same as a sport car or big SUV.Not quit correct. ALL cars, and the California is registered as a M1 Diesel Car in the U.K., that cost over £40,000 are taxed at this special rate for 6 years.

Although using the Cali as a first of second car, you end up polluting more on those journeys you would have otherwised driven a normal, less polluting car.

I remain a big fan of CO2 tax certificates.

Outanbout

Ok...very confused here, sorry.

What is the VED for a second hand 2017 VW California Ocean, 204ps, valued above £40k.

Chris.

What is the VED for a second hand 2017 VW California Ocean, 204ps, valued above £40k.

Chris.

Soton Campers

Southampton Campers

VIP Member

Trade Advertiser

Depends on when it was registered. I think anything post September 2017 was hit with the new charge.Ok...very confused here, sorry.

What is the VED for a second hand 2017 VW California Ocean, 204ps, valued above £40k.

Chris.

2into1

Née T4WFA. Now without Cali :(

Super Poster

Lifetime VIP Member

The ‘depends’ bit is correct but I think the cutoff was more like April or May 2017.Depends on when it was registered. I think anything post September 2017 was hit with the new charge.

L

Lightning

Ok...very confused here, sorry.

What is the VED for a second hand 2017 VW California Ocean, 204ps, valued above £40k.

Chris.

Check tax rates for new unregistered cars

Use the online tool to find the tax rate for new unregistered cars

Outanbout

Likely it’s pre sept 2017.

Does that put it into the £145 VED?

Many thanks for helping.

Chris.

Does that put it into the £145 VED?

Many thanks for helping.

Chris.

Outanbout

Likely registered pre sept 2017.

Does that put it into the £145 VED ?

Many thanks for helping.

Chris.

Does that put it into the £145 VED ?

Many thanks for helping.

Chris.

L

Lightning

On or after 1st of April 2017 puts it into the £465 VED rate according to the table in the above link.Likely registered pre sept 2017.

Does that put it into the £145 VED ?

Many thanks for helping.

Chris.

Similar threads

- Replies

- 11

- Views

- 2K

About us

The VW California Club is the worlds largest resource for all owners and enthusiasts of VW California campervans.