I'm guessing but in that case I'd assume it must be because you were the importer. Did you instruct a Customs Agent to clear the goods through customs? If yes, you were presumably the importer who was liable for the Duty, whereas with the Cali you aren't the importer. [Alternatively, the shipping agent in your previous cases, e.g. a DHL, might pay the actual Duty via their 'deferment account' with HMRC, then send you a bill for an amount equal to the duty.]

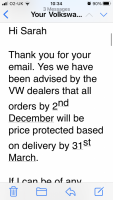

I keep using the expression "an amount equal to the Duty" because it's probably the important distinction. In the case of the Cali, VW is anticipating that the Duty payable by them to the UK Government may increase from nil to something, and they've referred to protecting against "price rises" in the OP's email because VW and their dealers are saying they'll absorb the cost of Duty imposed on them by HMRC and not pass it on to you through a price rise.

Sorry if I'm repeating myself, it's only because I've had CNN on for about 3 days straight so repetition has become normality.