T

turnitdown

Lifetime VIP Member

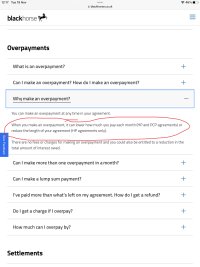

I owe VWFS about £55,000, which I've been planning to pay off more or less now (got the van a month ago). This will cost me about £750 in interest as a penalty. I notice though that it seems to be an option to throw lump sums at your PCP agreement. The website reads:

"If you have a PCP, Hire Purchase or Lease Purchase agreement you may be able to make a partial payment towards your agreement to reduce the monthly rentals or shorten the term of the agreement. If permitted you can do this as often as you wish, however the minimum the monthly rental can be reduced to is £50.00 and the minimum the term remaining can be reduced to is 1 month.

Once the payment is made the finance agreement will be re-calculated and confirmation will be sent in the post."

I'm wondering if this means that I could pay some large chunk, e.g. £20k, against the agreement a couple of times, reducing the amount owing to some small number (so the 3 months interest penalty is trivial) or bringing the agreement to a close within one or two months (if I don't pay it off early). Has anyone tried doing something like this?

It seems too obvious a way to avoid a 3-month interest penalty for it to be permitted, but I don't see how it isn't given that wording.

"If you have a PCP, Hire Purchase or Lease Purchase agreement you may be able to make a partial payment towards your agreement to reduce the monthly rentals or shorten the term of the agreement. If permitted you can do this as often as you wish, however the minimum the monthly rental can be reduced to is £50.00 and the minimum the term remaining can be reduced to is 1 month.

Once the payment is made the finance agreement will be re-calculated and confirmation will be sent in the post."

I'm wondering if this means that I could pay some large chunk, e.g. £20k, against the agreement a couple of times, reducing the amount owing to some small number (so the 3 months interest penalty is trivial) or bringing the agreement to a close within one or two months (if I don't pay it off early). Has anyone tried doing something like this?

It seems too obvious a way to avoid a 3-month interest penalty for it to be permitted, but I don't see how it isn't given that wording.