KevH

Wave at Ruby if you see us

Lifetime VIP Member

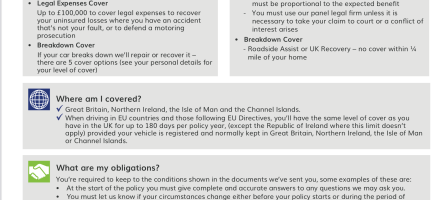

So…thinking back to the original posting - a warning to check European insurance cover - am I right in thinking that for your usual type of European visit LV cover is fine?

And for anything beyond that, including off road stuff (other than campsites) specialist cover needs to be considered?

And if you are not competent to tackle a drive, don’t attempt it?

And don’t blame somebody else if/when you ignore all of the above?

Hmmm… it’s not rocket science is it.

Just saying

And for anything beyond that, including off road stuff (other than campsites) specialist cover needs to be considered?

And if you are not competent to tackle a drive, don’t attempt it?

And don’t blame somebody else if/when you ignore all of the above?

Hmmm… it’s not rocket science is it.

Just saying