If you have additional property there are still some nice little wheezes to avoid tax.

Remortgage your buy-to-let property every five years to 60% or 75% to take out 60% or 75% of the increase in value *tax free*. And as a bonus the taxman will return to you by way of a tax credit 20% of your additional mortgage interest.

E.g. £1.5m property portfolio in 2018 (£900,000 mortgage; £600,00 equity). £1.9m in 2023.

Remortgage to £1.14m taking a tax free cash bonanza of £240,000.

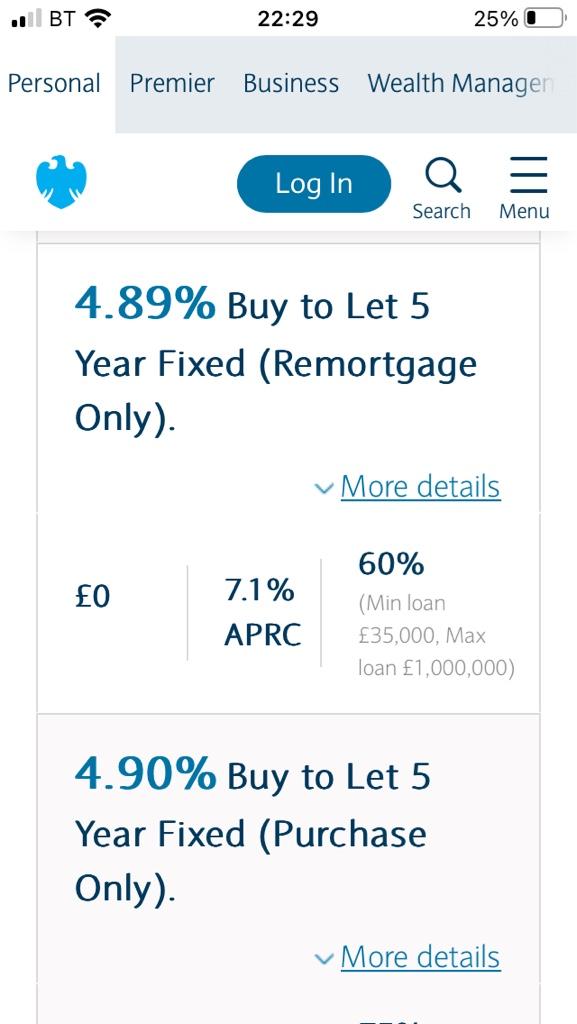

There will be a cost of extra interest, 4.79% is available on a five year fix interest only BTL, so £57,480 over five years but the philanthropic taxman will return £11,496 to you.

So over five years you will have netted over £194,000.

Of course this is dependent on property prices continuing to rise, in this example at ~5% per year. Property prices may well fall.

Sounds like a pack of cards teetering on the edge.

Remortgaging investment properties to that extent is getting dangerous.

Theres a couple of risky bits:

If your at 75% mortgage & there's a slight dip in the market you won't be able to get a remortgage.

Similarly getting a BTL mortgage without showing 25% more rent than mortgage is getting harder and harder, you could be effectively blocking yourself from getting a remortgage when the new one expires.

Where is the fixed rate mortgage coming from without fees? best I can find with a 5 year fix has almost £4k of fees + legals per property & as its a portfolio I'm guessing we are talking 3 or more properties.

The so called philanthropic taxman won't give you a penny, he may take less from you, but only if you've got enough rental income for it to be set against.

Capital gains tax, your increased property value is subject to capital gains on the increase - just your 2018-2023 bill is £112k, if you've owned them since say they were worth £500k you've got a capital gains bill of £392k coming if you ever sold, so your actual £1.9m property empire is worth say £1.9m less the £1.14 mortgage, less £392k tax less say £50k in estate agents / solicitors fees etc gives an actual worth of £318k. Pop your clogs & there's inheritance tax to pay so someone would be would be left with £190k.

If you've put your property empire into a trust to avoid the IHT of course you cant just take out another mortgage and walk away with the cash, its not yours - it belongs to the trust.

Similarly if you've done it as a limited company you cant get the cash out without it being taxed.

Then of course you best hope your tenants can keep up with the rent - even at 4.79% you've got a bill of £4,550 to pay every month on property that you only own a fraction of.