calibeach76

All part of the plan I'm afraid.Prob one more. Although market forecast peak 4.95% inflation will drop

the main issue is core inflation which actually increased.

Market forecast now peaks at 5.5%

All part of the plan I'm afraid.Prob one more. Although market forecast peak 4.95% inflation will drop

the main issue is core inflation which actually increased.

Market forecast now peaks at 5.5%

You’re right. My prediction was so bad I could get a job at the Bank of England.I thought it was a brave call from you when you made it!!!

You're probably too good!!You’re right. My prediction was so bad I could get a job at the Bank of England.

Interested in hearing more about the plan...All part of the plan I'm afraid.

Interested in hearing more about the plan...

Prob one more. Although market forecast peak 4.95% inflation will drop

the main issue is core inflation which actually increased.

Market forecast now peaks at 5.5%

Had a .18% above base rate life time tracker took it out years ago, great gamble that paid offAt 5.5% I will have some big decisions to make come November.

Barclays is currently offering a 2 year tracker at base rate plus 0.15%. If rates are likely to ease over the next two years a tracker might be the best option.

That’s an interesting one.As someone with 20+ years remaining on my mortgage (albeit fixed at 1.49% for the next 5 years) it’s got me questioning the wisdom of my Cali order so I guess it’s having an effect. Unfortunately there are millions out there who don’t have the choice to save or spend and all of their income’s already accounted for on basic necessities. Really worry for them.

Chatting with to our resident millennial last night. He was outraged that mortgage rates were 6% and wondered how long before they went back to their ‘normal’ 1%. Here lies the problem.

That’s an interesting one.

You are very fortunate if your mortgage is fixed at 1.49% for 5 years.

If you are of a cautious nature you could cancel the Cali and overpay the mortgage by as much as you can instead so that when you have to remortgage in 5 years time the reduced amount owed will mitigate the increased mortgage rate.

But then again if you really want that California….

Only you can decide.

If it’s fully paid for, even if disaster strikes, it would be worth a fair chunk of what you pay even as an emergency sale in five years time.Yeah this is the quandry and I guess is exactly what the BoE are hoping for! I am paying for the Cali in cash.

This is indeed part of the problem. I am technically a millennial (but I definitely don't "identify" as one)

Yeah that’s also the plan to be fair, we’ll move on our current family car early next year if we can get by using the Ocean. Though I do know insurers aren’t great fans of a Cali being the only car in the household…If it’s fully paid for, even if disaster strikes, it would be worth a fair chunk of what you pay even as an emergency sale in five years time.

It makes more sense if you are using it instead of a regular car, as then it’s just the difference in cost that you need to justify to yourself rather than the whole purchase price.

Oooo… I hadn’t thought of that! What matters is not the Generation you are born into, but the Generation you identify as. Now being born a Generation X, how should I identify myself!?

Another 0.5% on interest rates (an 11.1% increase not a 0.5% increase as commonly misreported). How can we economise? We’ve already switched from Waitrose, to Sainsbury’s, to Lidl. Where can we go from there…?

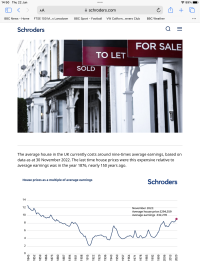

More seriously, 5% base rate is looking pretty reasonable in a historic context. When I bought my first flat in May 1990, the base rate was 14.88%. I still have the estate agent details for that flat. The asking price had been slashed from £69,950 to £57,000, (which is what I paid). Could we be heading towards a similar 15 to 20% drop in house asking prices?

That’s exactly what first time buyers need. What is a ‘normal’ average house price? Didn’t it used to be 5 x average salary?heading towards a similar 15 to 20% drop in house asking prices?

We’ve owned our house outright since 2015 and only debt is on the Van, but that’s on a 5 year PCP at 2.8%. If inflation cannot be controlled, we’ll be paying off the balloon payment in devalued pounds. Thank you VW finance, I’ll be forever grateful.Due to the number of people already on fixed rate, their may be a lag between now and house price crash, recession and doom. Of course it may not happen at all. There may be a long period of choppy churn, where as some default, others buy the dip, this and lack of supply, moves prices sideways. Who knows.

Thankfully we are mortgage and debt free. Feel so fortunate to only have crippling inflation eroding our income, savings, and future pensions.

The VW California Club is the worlds largest resource for all owners and enthusiasts of VW California campervans.