soulstyledevon

Kennycalifornia

Super Poster

VIP Member

- Messages

- 6,519

- Vehicle

- Cali now sold

They offered it a while back and I thought, 7%… it was worth sticking some of the salary in there.

They offered it a while back and I thought, 7%… it was worth sticking some of the salary in there.

Nationwide offer 8%.

But I think Lloyds £400pm at 6.25% gives a better payout than NW £200pm at 8%.

Plus I already have a current account with Lloyds.

The £400pm into the Lloyds account is destined for JSIPPs for my two boys where it will receive a 25% Government cash bonanza before being locked away for nearly 5 decades!

If the JSIPPs achieve 8.5% average growth over 5 decades, every £1 invested over the next 12 months will be £76 in 2083.

£1 x 1.029 x 1.25 x (1.085^50)

Are the JSIPPs in your name or the child’s…?

Just watched all of that.. it’s quite long but well worth itSome great advice in here that I wish I'd been told when I was 20. Who wants to be fiddling and faffing, just DD 5-10% of income monthly into a Target Date Fund and forget (until you can increase your contributions).

Some great advice in here that I wish I'd been told when I was 20. Who wants to be fiddling and faffing, just DD 5-10% of income monthly into a Target Date Fund and forget (until you can increase your contributions).

The don't buy a house recommendation only works if you can live somewhere cheaper.

No, I don’t think that is what he is saying.

£750,000 house.

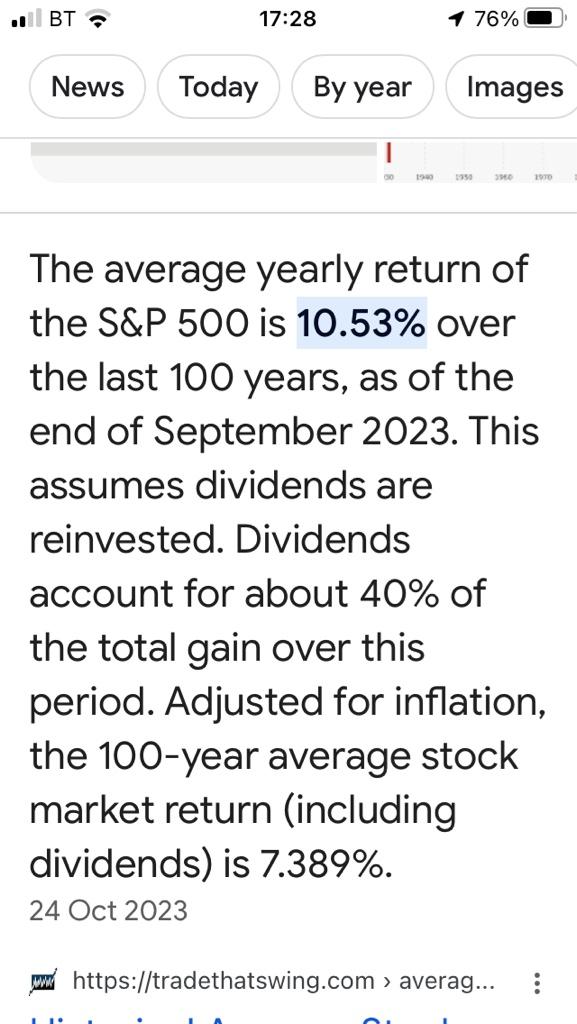

Instead of buying it, put the £750,000 into the S&P 500 and get 7% return (after inflation). £52,500 pa gain.

So long as your rent < £52,500 pa (£4,375 pm) you are quids in, and you don’t have to mess around with maintenance costs.

They have made errors in their analysis, eg gran bought a house 55 years ago for $10,000 is now worth $1,000,000. They said as it has more or less only tracked inflation gran hasn’t made any money. They conveniently ignore the value gran has had from that house.

Totally understood, but if the next daughter thinks she's living at home until she's got £750,000 available to invest so that she can then go and rent somewhere she has got a shock coming.....

A couple of questions then:

Where do you live while you are assembling the £750k ?

How do you save £750k by the time your parents are fed up with you treating their place as a hotel?

Why would granny want to make any money on a house - all she wants is somewhere to live?

If you are spending the 7% return on your £750,000 on rent & not reinvesting it, due to inflation your capital is effectively being eroded.

What do you do when your rent due to inflation exceeds your returns.

I would suggest that granny started with a house & in 55 years later still had a house worth in real terms what she paid for it.

Our investor started somehow with £750,000 & 55 years later after renting all his life has £750,000 in the bank which after 55 years of inflation is worth peanuts in real terms.

Of course being a renter in the uk with its unscrupulous landlords means in those 55 years he's had to move 110 times, lost his deposit 110 times & got totally fed up waiting for the landlord to fix anything. All the time looking with jealousy at the landlords mansion paid for by the income from his buy-to-lets.

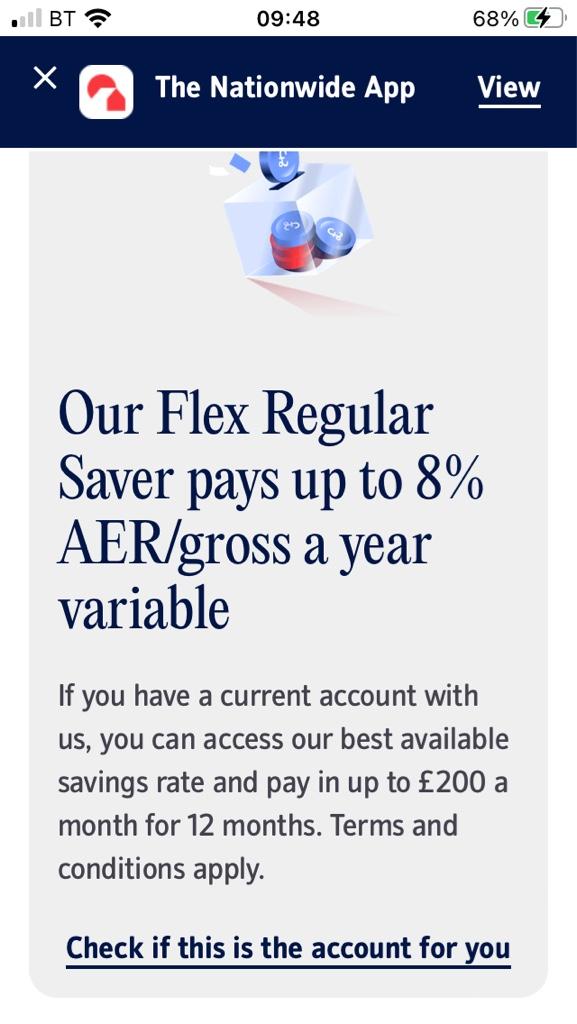

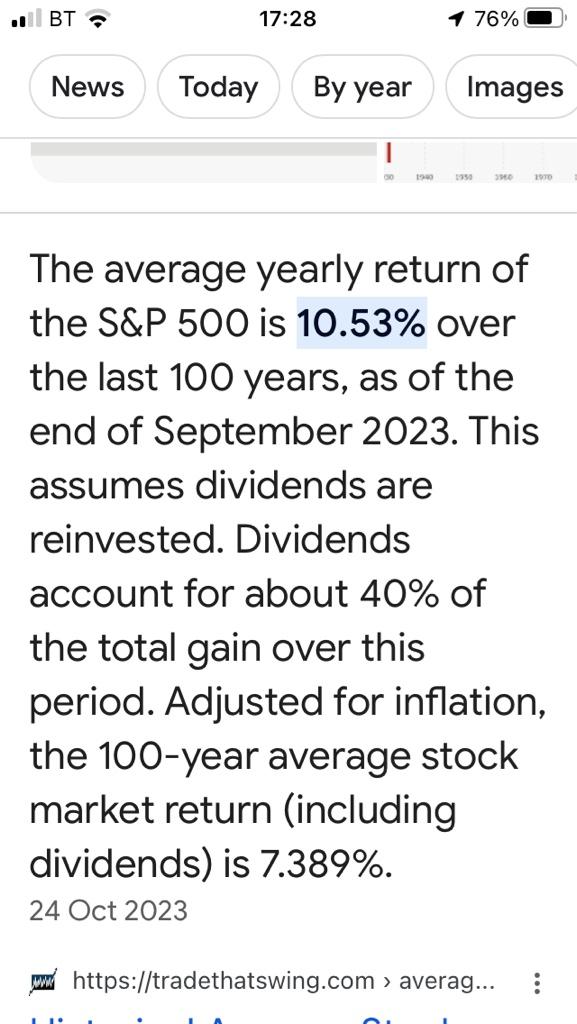

The 7% figure they quoted was after deducting inflation. I cannot recall precisely the figure they gave for S&P 500 growth pa over the past 100 years but I think it was 11 or 11.5% (seems optimistic to me).

Alarm bells are ringing at the first mention of borrowing money to invest.......Several questions there…

But basically, I think the principle of what they are saying stands true whether it is a £750,000 house or £75,000 flat. Whether you have the cash to buy outright or need to borrow: investing in the S&P 500 gives better returns.

It is optimistic - 6.6% after inflation is the figure you are looking for. The problem I had with the video is that he gives the impression that the S&P 500 gives a sure and steady paint drying return. It’s not like that at all. The market is usually overvalued or undervalued to its intrinsic value at any given time. Boom and bust. That‘s why your 50 year plan for your boys is an excellent idea.

View attachment 116033

Alarm bells are ringing at the first mention of borrowing money to invest.......

He was more specific than global S&Ss. It was the S&P500. His 7% adjusted for inflation looks about right.

The above ign

That is not what I intended to suggest.

What they are saying is whether you can buy a house outright or need to borrow to buy a house rethink. It may be better to rent and invest any house deposit and any excess cash.

Where I think their analysis is wrong is that buying a house to live in is a form of investment, and you get value out of its use.

But borrowing to invest is perfectly OK, so long as borrowing costs are lower than your investment returns.

One of my flats is mortgaged for £43,400. By remarkable coincidence that is nearly the same as the value of my ISA: £39,400 (which cost me £40,000). That is essentially the same thing as borrowing to invest.

My mortgage costs will be 5.53% over the next 62 months (I could deduct the 20% tax credit from the 5.53% to give me 4.424% if I wanted to work out the real cost).

So long as my return on my ISA > 5.53% (or > 4.424%), my decision to borrow to invest will have been a wise choice. But even if the value of my ISA continues to fall, my losses are unlikely to be catastrophic.

But money put into a Junior SIPP is not accessible until the child has reached a ripe old age, so bad habits would be irrelevant. We started one for each of our grandchildren and dribble a bit of money in now and then.I’ve been uneasy naming policies in my child’s name. Purely in case he turns out bad. Hopefully he takes the right paths. But you never know. I would rather give the money to charity, than fuel a drink, drug or gambling addiction…

Works out at £135 interest after a year (less tax if you pay it) or 3.75% on the overall sum. As I said I find these a bank marketing dream.....It‘s a cracker - and £175 to switch your current account to them. Not for me though, I’ve been with Bank of Scotland for 54 years and I can remember the sort code and account number. That’s important for us old people.

View attachment 116014

Based on the maximum £300, I add....Works out at £135 interest after a year (less tax if you pay it) or 3.75% on the overall sum. As I said I find these a bank marketing dream.....

Based on the maximum £300, I add....

But money put into a Junior SIPP is not accessible until the child has reached a ripe old age, so bad habits would be irrelevant. We started one for each of our grandchildren and dribble a bit of money in now and then.

Not just JSIPPs. I started a new SIPP after I retired and put my original SIPP into drawdown. I’m allowed by HMRC to put £2880 pa into it up until I’m 75. My £2880 each year morphs into £3600And the great plus with a JSIPP is the 25% cash bonanza from the taxpayer.

£240 per month magically morphs into £300 per month.

And I would like to feel that through their working life, knowing that there is a pot of money waiting for them on retirement, will give my boys the security to be more adventurous with the things they want to do.

The VW California Club is the worlds largest resource for all owners and enthusiasts of VW California campervans.