Tomdbreeze

Trade Advertiser

Hi Guys

I know there has been a lot of confusion around the changes of VED (Vehicle Excise Duty), the timing and how it applies to the registration process of a New California at the moment. I'm going try and explain what we have learned and hope this helps:

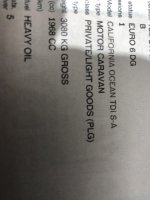

1 - Once the Vehicle has landed in the UK (doesn't have to be with the dealer) we can request a V55 form from the DVLA. This is a manual process to enable the Dealer to register the vehicle as a PLG (Private Light Goods Vehicle). This then means it can be taxed at the new VED lower rate.

2 - Once we have received the V55 form we have to send that to the DVLA so that they can allocate it a REG Number, unfortunately you will not be able to choose your REG Number like we usually offer as it has to be allocated by the DVLA. If you have a Private Plate you will then need to send your dealer the physical copy of your retention document so they can post that along with the V55 form.

3 - Once the DVLA has received the V55 form they will then inform your dealership of the REG number so it can be fitted to your vehicle.

4 - At present this manual process is taking about a week to turn around.

If the manual process is not followed then the vehicle, even if registered after 12th March, will revert to the previous VED.

I hope this makes sense and provides some more clarity on a situation that has been brought on us all with no prior warning. If you have any specific questions relating to your own vehicle purchase, even if you didn't purchase from me or one of the team at Breeze Van Centres, then please let me know. I'm more than happy to help.

Tom

California Specialist

Breeze Volkswagen Van Centre Poole

I know there has been a lot of confusion around the changes of VED (Vehicle Excise Duty), the timing and how it applies to the registration process of a New California at the moment. I'm going try and explain what we have learned and hope this helps:

1 - Once the Vehicle has landed in the UK (doesn't have to be with the dealer) we can request a V55 form from the DVLA. This is a manual process to enable the Dealer to register the vehicle as a PLG (Private Light Goods Vehicle). This then means it can be taxed at the new VED lower rate.

2 - Once we have received the V55 form we have to send that to the DVLA so that they can allocate it a REG Number, unfortunately you will not be able to choose your REG Number like we usually offer as it has to be allocated by the DVLA. If you have a Private Plate you will then need to send your dealer the physical copy of your retention document so they can post that along with the V55 form.

3 - Once the DVLA has received the V55 form they will then inform your dealership of the REG number so it can be fitted to your vehicle.

4 - At present this manual process is taking about a week to turn around.

If the manual process is not followed then the vehicle, even if registered after 12th March, will revert to the previous VED.

I hope this makes sense and provides some more clarity on a situation that has been brought on us all with no prior warning. If you have any specific questions relating to your own vehicle purchase, even if you didn't purchase from me or one of the team at Breeze Van Centres, then please let me know. I'm more than happy to help.

Tom

California Specialist

Breeze Volkswagen Van Centre Poole