P

Portland

My father, who was domiciled in France, died a year ago. My mother had to be admitted to a French dementia home and the family house is due to be sold. I want to bring a few family items back to the UK as we return from a trip to the Dordogne at the beginning of September.

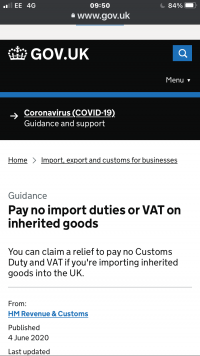

I’ve checked the HMRC website and it appears that duty must be paid for goods over the value of £390, even if they are family property!

I wish to bring an Edwardian card table back that is worth just over the duty free limit. I will try and get a local written valuation that is £390 or less! Farcical, as I could mock one up on the computer?

My question is how inquisitive are UK customs when returning through the tunnel and what evidence do they ask for to prove which are your own possessions?

I had wondered whether I could say the Cali fold out table is broken and it is my usual practice to dine and play cards using an antique one!

I’ve checked the HMRC website and it appears that duty must be paid for goods over the value of £390, even if they are family property!

I wish to bring an Edwardian card table back that is worth just over the duty free limit. I will try and get a local written valuation that is £390 or less! Farcical, as I could mock one up on the computer?

My question is how inquisitive are UK customs when returning through the tunnel and what evidence do they ask for to prove which are your own possessions?

I had wondered whether I could say the Cali fold out table is broken and it is my usual practice to dine and play cards using an antique one!