Don't forget though that the director of that imaginary company if they so wish will drive down profit to reduce their corp tax bill. Investments, pension contributions, expenses, business entertainment, work from home allowance, various reliefs, etc. Also you'd take £12,500 in income tax-free to use your allowance, and no doubt there are many other ways to reduce your tax burden. I'd say in your example tax could be nearer 30% for that fortunate individual. That's before they've made their spouse a director too and got good use of their allowances.

That sounds like a jealous person thinking that directors get away with paying bugger all tax.

So lets correct a few assumptions above:

1. To be able to take a dividend you have to declare a profit & that profit will be taxed. So £200k profit made 19% Corporation tax paid. = £38,000

2. Where's this magic £12,500 tax free allowance? once you draw income whether its a salary or dividends & the total goes over £100,000 you loose any tax free allowance at the rate of 50p for every £1 you go over, total is over £125k so zero tax free allowances.

3.Work from home allowance Tax relief on £6/ per week - big deal also available to all employees.

4. Investments - what investments? if the company invests in something it doesn't get the shareholder anything, it might make the company some money but there's no way of getting that money to a shareholder without paying tax.

4.Income tax paid on what's left of that £200k after corporation tax as below £49,419

The extra tax to pay is £49,419 (30.5% of the dividend).

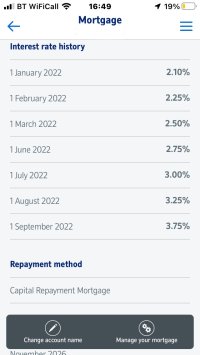

Band Rate Lower Limit Upper Limit Tax

basic rate 8.8% 0 £37,700 £2,073

higher rate 33.8%. £37,700 £150,000 £37,901

additional rate 39.4% £150,000 - £9,444

Total Tax: £49,419

So if I declare a profit of £200k on my company & try & take it as dividends I end up paying £87,419.00 tax

On the other hand if I was an employee enjoying all those little perks like getting paid every month, sick pay, paid holidays on a £200k salary I would have paid £74,960 in income tax & £9,861.48 in national insurance totalling £84,821.48 in taxes

So company owner/shareholder pays more tax than employee.