You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Amarillo

Tom

Super Poster

VIP Member

Well until you've actually sold something you havn't made a penny.

So you are not going to be able to dispose of the property without paying a tax in one form or another.

If its inheritance tax you are paying its 40% on the whole value, I assume if your buy to lets are £400k your main house takes up all the tax free part of any inheritance.

If you are unwise enough to sell up & suddenly pop your clogs on that £400k house you could pay £56k capital gains tax, & then your estate pays 40% on the remaining £164k so another £65.6K By the time you've forked out for estate agents, solicitors, etc your £220k is down to £90k

Even if someone did sell their £400,000 house and paid their £52,556 CGT bill they’d still be £££ in on their original £20,000 investment.

Net rental income should easily cancel out net interest payments.

£400,000 - £180,000 - £52,500 = £167,500

8 times gain on the original £20,000 punt.

andyinluton

Super Poster

VIP Member

- Messages

- 7,740

- Vehicle

- T6.1 Ocean 204 4 motion

Isn't that less another £20k, the money you put in in the first place? so £147kEven if someone did sell their £400,000 house and paid their £52,556 CGT bill they’d still be £££ in on their original £20,000 investment.

Net rental income should easily cancel out net interest payments.

£400,000 - £180,000 - £52,500 = £167,500

8 times gain on the original £20,000 punt.

What are you going to do with the £147k, leave it as inheritance - great thats another 40% to the tax man.

Amarillo

Tom

Super Poster

VIP Member

Isn't that less another £20k, the money you put in in the first place? so £147k

What are you going to do with the £147k, leave it as inheritance - great thats another 40% to the tax man.

My wording was clumsy: the £20,000 has grown to 8 times the size.

So what could you do with your £167,000? Buy another 8 houses after the 2022 - 2025 property crash?

Last edited:

Lambeth Cali

Super Poster

VIP Member

I see the ratings agencies have joined the “anti growth coalition”

“Rating agency Fitch lowered the outlook for its credit rating for British government debt to “negative” from “stable” on Wednesday, citing risks posed by the measures announced in the chancellor’s mini-budget.”

We’re going down the plug hole.

“Rating agency Fitch lowered the outlook for its credit rating for British government debt to “negative” from “stable” on Wednesday, citing risks posed by the measures announced in the chancellor’s mini-budget.”

We’re going down the plug hole.

G

GrumpyGranddad

Guest User

VW California - The image that comes to mind is a flower-adorned VW camper with big eyes, being driven down a coastal highway in California by counterculture types in flared trousers, playing guitars and nursing impossible hairdos on beaches south of San Francisco.

Seems that Yesterday’s Hippie Is Today's Capitalist

Seems that Yesterday’s Hippie Is Today's Capitalist

soulstyledevon

Kennycalifornia

Super Poster

VIP Member

- Messages

- 6,519

- Vehicle

- Cali now sold

VW California - The image that comes to mind is a flower-adorned VW camper with big eyes, being driven down a coastal highway in California by counterculture types in flared trousers, playing guitars and nursing impossible hairdos on beaches south of San Francisco.

Seems that Yesterday’s Hippie Is Today's Capitalist

Volkswagen want £80k for a new California.

One of my good friends is a full time hippy surfer, he doesn’t own sheet, never mind a Volkswagen at todays prices…

G

GrumpyGranddad

Guest User

Yes, crazy prices these days but that seems to apply to all new vehicles, especially EVs !!Volkswagen want £80k for a new California.

One of my good friends is a full time hippy surfer, he doesn’t own sheet, never mind a Volkswagen at todays prices…

My first brand new car was a metallic silver VW 1303S Beetle in 1974. £1250 I seem to remember

Velma's Dad

Super Poster

VIP Member

The Conservatives are systematically painting themselves into a corner. They seem determined to set themselves, one by one, against almost every institution, class and group in society. It's some kind of socio-political death cult screaming at everyone else from a bunker. They have abandoned the centre ground and so are doomed electorally.I see the ratings agencies have joined the “anti growth coalition”

“Rating agency Fitch lowered the outlook for its credit rating for British government debt to “negative” from “stable” on Wednesday, citing risks posed by the measures announced in the chancellor’s mini-budget.”

We’re going down the plug hole.

Amarillo

Tom

Super Poster

VIP Member

The Conservatives are systematically painting themselves into a corner. They seem determined to set themselves, one by one, against almost every institution, class and group in society. It's some kind of socio-political death cult screaming at everyone else from a bunker. They have abandoned the centre ground and so are doomed electorally.

Now Truss is plotting to upset hardline Brexiteers by heading for the inaugural meeting of the European Political Community in Prague. She’s even offered for the UK to host the second meeting.

I’m not saying it’s a bad thing that Truss is attending, only that she risks alienating one of the few groups that still support her.

Californication69

Bill

Super Poster

Lifetime VIP Member

Funny you should say that !VW California - The image that comes to mind is a flower-adorned VW camper with big eyes, being driven down a coastal highway in California by counterculture types in flared trousers, playing guitars and nursing impossible hairdos on beaches south of San Francisco.

Seems that Yesterday’s Hippie Is Today's Capitalist

It’s exactly what I’ve just seen in Carmel !

G

GrumpyGranddad

Guest User

Nice

soulstyledevon

Kennycalifornia

Super Poster

VIP Member

- Messages

- 6,519

- Vehicle

- Cali now sold

Carmel isn't exactly cheap hippy...

I stayed there for a few days back in 2008. Good food places to eat round there. Enjoy

G

GrumpyGranddad

Guest User

Hog’s Breath Inn ?Carmel isn't exactly cheap hippy...

I stayed there for a few days back in 2008. Good food places to eat round there. Enjoy

sidepod

Super Poster

Lifetime VIP Member

- Messages

- 6,970

- Vehicle

- T4 PopTop

On the subject of hippies/counterculture etc, I've been watching Aquarius. All about Manson and his "family". He was a mad, bad MoFo!

Lambeth Cali

Super Poster

VIP Member

Whenever I take a ‘risk test’ from my financial advisor, I come out as willing to take high risk. Most of my pensions are in shares that score a risk of 5 or 6 out of 7, I think. I tell him that since 2008, and the near collapse of banks, I don’t believe there are ‘low risk investments’ so I would rather accept risk and hope for high returns.

This stuff about bonds nearly collapsing seems just bonkers -

www.theguardian.com

www.theguardian.com

Weren’t they supposed to be safe? I suppose that’s why BoE stepped in. Still seems bizarre.

This stuff about bonds nearly collapsing seems just bonkers -

Bank confirms pension funds almost collapsed amid market meltdown

Official explains how promise to buy up to £65bn of government debt staved off destructive UK financial spiral

Weren’t they supposed to be safe? I suppose that’s why BoE stepped in. Still seems bizarre.

Velma's Dad

Super Poster

VIP Member

For about 20 years, bonds were the standard hedge in a retail investor's portfolio because they tended to be negatively correlated against equites. However for widely debated reasons, that inverse relationship between bonds and shares started to go wonky more recently and indeed in the very long run (ie 50+ years) bonds have spent long periods positively correlated which makes them of limited use in de-risking a portfolio.Whenever I take a ‘risk test’ from my financial advisor, I come out as willing to take high risk. Most of my pensions are in shares that score a risk of 5 or 6 out of 7, I think. I tell him that since 2008, and the near collapse of banks, I don’t believe there are ‘low risk investments’ so I would rather accept risk and hope for high returns.

This stuff about bonds nearly collapsing seems just bonkers -

Bank confirms pension funds almost collapsed amid market meltdown

Official explains how promise to buy up to £65bn of government debt staved off destructive UK financial spiralwww.theguardian.com

Weren’t they supposed to be safe? I suppose that’s why BoE stepped in. Still seems bizarre.

If you're not expecting to need to access your capital in the next few years a 100% equities portfolio (suitably diversified, of course, by which I mean a basket of trackers spanning several geographical markets) is IMO quite reasonable. Of course, you then have to be prepared to sit tight and never ever sell even when the market goes bonkers for several months and you're maybe looking at a 20%+ drawdown (eg 2007/8). But that's extremely hard for a lot of investors to stomach, and I'm guessing no high-street financial adviser will be prepared to recommend equities-only, so you'd have to be prepared to build your own portfolio using a platform like Hargreaves Lansdown.

Amarillo

Tom

Super Poster

VIP Member

That’s exactly what I do with the boys’ JISA. Equally split between UK tracker, Europe (excluding UK) tracker, US tracker, Japan tracker, Asia (excluding Japan) tracker and Emerging Markets tracker.If you're not expecting to need to access your capital in the next few years a 100% equities portfolio (suitably diversified, of course, by which I mean a basket of trackers spanning several geographical markets) is IMO quite reasonable.

The fees for tracker funds are ridiculously low, and if you take an average of all managed funds all they do is track the market and charge you heavily for the privilege.

I use Fidelity.

Velma's Dad

Super Poster

VIP Member

Trackers have on average outperformed managed funds after fees ever since they were introduced in the 1980s. But financial advisers will still try to give you all kinds of reasons why "managed funds still have their place..." yada yada. (Proving that it's almost impossible to get a man to understand something, when his salary depends on him not understanding it.)That’s exactly what I do with the boys’ JISA. Equally split between UK tracker, Europe (excluding UK) tracker, US tracker, Japan tracker, Asia (excluding Japan) tracker and Emerging Markets tracker.

The fees for tracker funds are ridiculously low, and if you take an average of all managed funds all they do is track the market and charge you heavily for the privilege.

I use Fidelity.

soulstyledevon

Kennycalifornia

Super Poster

VIP Member

- Messages

- 6,519

- Vehicle

- Cali now sold

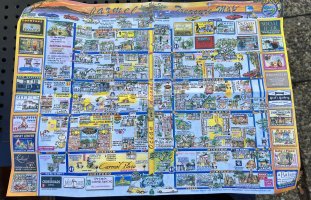

View attachment 100219

Found it on San Carlos. We at Signature having breakfast !

Dametra, I remember having a brilliant night in there.

Although, could've been very drunk...

Im sure Clint Eastwood has a restaurant there too, but can't remember the name of it.

G

GrumpyGranddad

Guest User

He was the owner of the Hog’s Breath Inn, I believe.Dametra, I remember having a brilliant night in there.

Although, could've been very drunk...

Im sure Clint Eastwood has a restaurant there too, but can't remember the name of it.

soulstyledevon

Kennycalifornia

Super Poster

VIP Member

- Messages

- 6,519

- Vehicle

- Cali now sold

He was the owner of the Hog’s Breath Inn, I believe.

Ok, yes we went there.

I remember my wife wanted to visit, she was hoping to bump into him...

Women

Californication69

Bill

Super Poster

Lifetime VIP Member

We going Mission Ranch this evening, he owns it and is a regular there at the Piano bar. So hopefully I can thank him for making The Good, The bad, and the ugly. Best film ever.

Our host knows him and plays Golf with him. It’s a strange world here

Our host knows him and plays Golf with him. It’s a strange world here

Lambeth Cali

Super Poster

VIP Member

He was mayor of Carmel twice. From 1986 and 2001.He was the owner of the Hog’s Breath Inn, I believe.

Similar threads

- Replies

- 42

- Views

- 12K

About us

The VW California Club is the worlds largest resource for all owners and enthusiasts of VW California campervans.