JaneJ

VIP Member

Hey there chaps - wondering if anyone can help.

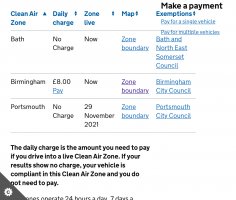

Just looking at driving into Bath this weekend and also London next weekend.

I put my Vehicle Reg into the system (2013 SE 180 4Motion BMT) and it says I am liable for the charge in Bath.

My friend put his vehicle reg in (2011 SE 180) and he has no charge - even though it's an older vehicle. I also put in the reg of my previous Cali (2014 SE BMT) and that also doesn't get charged.

Enter the vehicle registration (number plate) | Drive in a clean air zone | GOV.UK

vehiclecheck.drive-clean-air-zone.service.gov.uk

The only difference I can see is the 4Motion - Anyone else experience this strange anomaly?

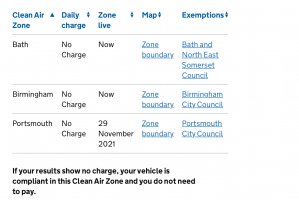

Unlike your friend's exempt 2011 SE 180, my similar Cali is not exempt because its vehicle tax category is Private Light Goods, not M1. When I queried this with Bath's CAZ team, I received the following response:

The charge is dependent on the category of the vehicle and its Euro standard. Any vehicle classification which is in N1 and with a non-compliant engine (below Euro-6 standard for diesel and below Euro 4 for petrol) will be charged for entering the clean air zone. Unfortunately, this is not based on looks or style and we do not have any input into which classification vehicles are assigned as this is determined by the DVLA.

Recently there has been an exemption added for motorcaravans but only with M1 on their V5c. This exception is simply because Bath Council consulted that no cars (M1 category) would be charged in Bath’s CAZ. Therefore, we have honoured that. Unfortunately, if your vehicle is not classified as M1 then it will be chargeable if it is a pre Euro 6 diesel.

As PLG, we've paid less vehicle tax, so I suppose we can't have it all ways.