Trail Planner

Time to reflect on California ownership and do some man (or woman) maths (the wonky maths to justify a purchase).

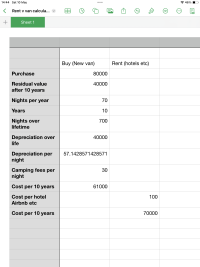

How many nights a year do you have to use it to break even?

I assume, for my calculations, I'll own it for 10 years, and it replaces a second vehicle I would own to ghet around. I also assume that I would do the same amount of exploring, but use AirBnB, B&B, Hotels and so on, with that second vehicle, similar mileage. I know it is not the same experience, but it helps understand the premium you would pay for owning a California (or other van).

I have owned my T4 California Westfalia now for 24 years, and recently it has been used for 70 nights a year, so over its lifetime, with kids, who at first love it, then hate it, then want to borrow it I think, taking in to account some fallow years, I have spent ~1,200 nights in it. This easily makes a case for ownership and I was very lucky to be able to afford in 2001 (purchase price £26k).

Cost of owning a VW camper - Cost of owning a car - savings made from accommodation and food = is this negative or positive for the number of nights it is used.

What am I missing? (financial responses only please, as I know the value of ownership is subjective).

trailplanner.co.uk

trailplanner.co.uk

How many nights a year do you have to use it to break even?

I assume, for my calculations, I'll own it for 10 years, and it replaces a second vehicle I would own to ghet around. I also assume that I would do the same amount of exploring, but use AirBnB, B&B, Hotels and so on, with that second vehicle, similar mileage. I know it is not the same experience, but it helps understand the premium you would pay for owning a California (or other van).

I have owned my T4 California Westfalia now for 24 years, and recently it has been used for 70 nights a year, so over its lifetime, with kids, who at first love it, then hate it, then want to borrow it I think, taking in to account some fallow years, I have spent ~1,200 nights in it. This easily makes a case for ownership and I was very lucky to be able to afford in 2001 (purchase price £26k).

Cost of owning a VW camper - Cost of owning a car - savings made from accommodation and food = is this negative or positive for the number of nights it is used.

What am I missing? (financial responses only please, as I know the value of ownership is subjective).

VW Campervan

Our VW California Westfalia campervan was purchased and imported from Germany from new in 2001. It replaced a T3 high top VW water-cooled campervan we owned in the late 90’s. She is a 2.5l 5…