Pucci Mike

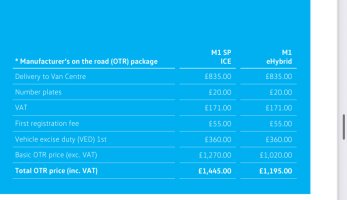

Can engine explain the current road fund licence fee on say a new T7 registered after 1 April 2025. I’ve 2 conflicting answers from main dealers.

One says “from 1 April if list price is over £40k it will incur an additional £425 from the second time the vehicle is taxed. “

Another dealer categorically states that RFL is currently £360 with no additional tax

Thanks

One says “from 1 April if list price is over £40k it will incur an additional £425 from the second time the vehicle is taxed. “

Another dealer categorically states that RFL is currently £360 with no additional tax

Thanks