Thank you, Tim. Out of interest, and so far as you are aware, is Rotherhithe tunnel a rare case or are there many places with N1 restriction? I don't recall ever seeing them (though probably will, now you have alerted me).

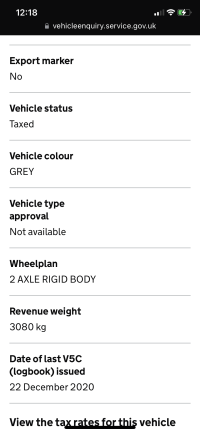

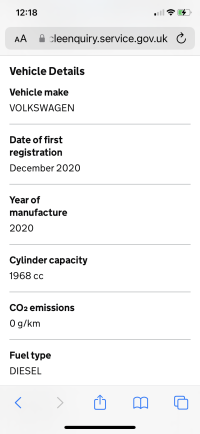

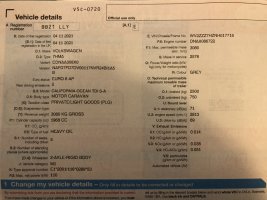

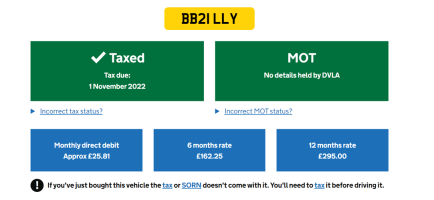

So, is it the general consensus that a new Ocean delivered this year, subject to any future change in legislation: will probably be classed as 'N1 Private/Light Goods Class (PLG)' and pay £295 at current rates); but (at the whim of DVLA) might in the alternative be classed 'M1 Diesel Car' and pay £520 for 5 years and then £100-200 thereafter?