vmaxkiddy

Lifetime VIP Member

A weed is a lovely flower in the wrong place.If you're not sure you're probably a weed...

A weed is a lovely flower in the wrong place.If you're not sure you're probably a weed...

A flower is just a weed that some one likes.A weed is a lovely flower in the wrong place.

I quite like weedA flower is just a weed that some one likes.

I quite like weed

Invest in tulip bulbs and selectively water.In the news today - Dutch inflation leaps to 17%, boosted by high energy prices. Wonder what their strategy will be?

Today I signed up to another 10 years at 3.05% fixed.

I had planned to remortgage another £200k over, for renovation work we wanted to do next spring. Instead we decided not to saddle ourselves with unnecessary debt and will move the build over a 5 year period using savings and shares.

So much for trickledown economics…

Ooh my daughter lives near that pub, she will be disappointed by the clienteleI note that Truss and Kwarteng cooked up their hare-brained scheme in a pub just around the corner from me.

Near the Greenwich pub where the mini-budget was born, Londoners share their fears

Citizens already describe feeling depressed, furious and highly anxious about the futureamp.theguardian.com

I wonder what they were drinking?

Ten years at 3.05% is pretty good. Were there any fees?

It sounds like a stunning deal. Yes - Britain might enter into a two year deep recession with interest rates tumbling to 0.1%, and ten year fixed rate deals for 1.99%. But what you have is certainty. Do you sums and see if you can overpay so the mortgage will be redeemed at the end of the ten year period.£749.

We decided the long term stability worked for us. Even if the rates drop, i can't see them going back to the historically low rates we've seen these last 10 years.

We can make 10% (of balance) over payments each year during the period too.

I might kick myself locking in for such a long amount of time, but not half as much, as i regret not buying Tesla stock when it was affordable...

It sounds like a stunning deal. Yes - Britain might enter into a two year deep recession with interest rates tumbling to 0.1%, and ten year fixed rate deals for 1.99%. But what you have is certainty. Do you sums and see if you can overpay so the mortgage will be redeemed at the end of the ten year period.

I think I’ve found the deal.

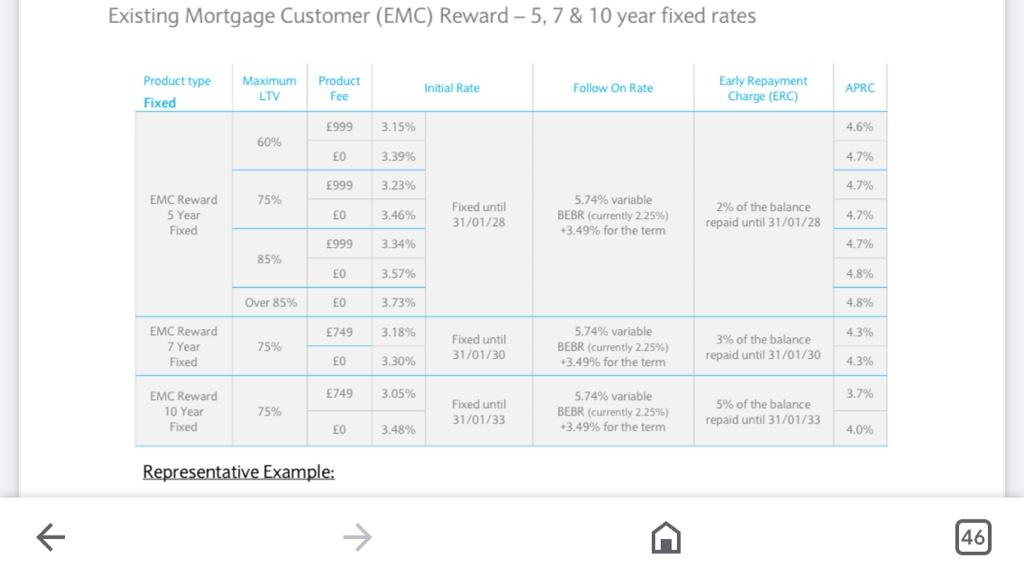

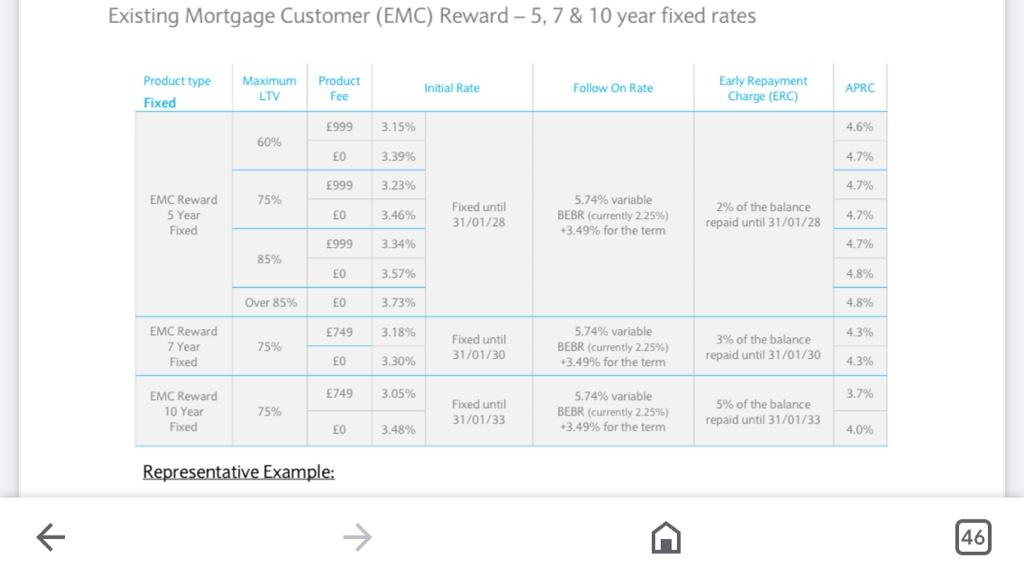

1 year fix 3.58% no fee.

2 year fix 3.22% £999. (£500 py)

3 year fix 3.30% £999. (£333 py)

5 year fix 3.23% £999. (£200 py)

7 year fix 3.18% £749. (£107 py)

10 year fix 3.05% £749. (£75 py)

This gives some indication of where the Barclays Boffins think interest rates will be headed over time. It is the reverse of how things were this time last year with a premium being demanded for longer fixes.

My wife and I were split.

I wanted to hit the 5 year fixed, she wanted the 10.

We went for the 10, but have shook on a 5 year £1000 bet. Considering how risk adverse she is, she still wanted the wager.

The stakes are high in this house…

I agree with you, our best bet, is to pay down each year and bring down the overall cost.

You can make a cash overpayment of 5% of your balance each year without penalty. This will reduce your monthly repayments, but will not affect the length of term.

@Amarillo whats your take on Independent Mortgage Advisors. Personally, I’ve never used one. I scan the market for the best policies I can find and approach the lender directly.

I can’t get my head around paying someone to do the search for me…???

As for Independents getting special deals, I don’t buy it. They charge you £500 for an appointment or receive commission from the lender on what they sell. Would they lead you to a product they can’t make anything from. I doubt it.

You can normally do up to 10%; Either monthly overpayment or lumpsum each year (but must be done each year, ie - you can’t just overpay by 20% in the 2nd year).

If done from day 1 you reduce your term from 25years to approx 17/18 years.

Important thing if household budget allows is to overpay from day 1, then you don’t notice the money has gone!

Barclays have their own idiosyncrasies. On the ten year fix max lump sum is 5%. Any more that that and it’s a 5% penalty charge of the excess. This is true for the whole of the ten year fixed term.

However, you can make regular overpayments of three times the minimum payment (minus a penny) without penalty.

See green highlight.Are you sure @Amarillo .

We were told yesterday by Barclays, you can overpay 10% of the outstanding balance per year. Any more would result in a 5% penalty charge…

The VW California Club is the worlds largest resource for all owners and enthusiasts of VW California campervans.