You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

P

Pixcels

Lifetime VIP Member

You may have noticed that all my info came from the DVLA site but as you can see from earlier posts, it is not so straightforwardAll the info is on the DVLA site,

G

GrumpyGranddad

Guest User

What do you do about the insurance @Ozzy Pete ?I pay monthly £27.56 which is a bit more than a one off payment but makes it easier to SORN it on the months I have no intention of using it.

Ozzy Pete

Just because it’s not taxed doesn’t mean it’s not insured. You cannot tax a vehicle for the road unless it’s insured. You can use a vehicle on the road that isn’t taxed to take it for an MOT. My bike is on SORN but still insured.What do you do about the insurance @Ozzy Pete ?

Ozzy Pete

I always keep them insured in case of fire, theft or weather damage.Just because it’s not taxed doesn’t mean it’s not insured. You cannot tax a vehicle for the road unless it’s insured. You can use a vehicle on the road that isn’t taxed to take it for an MOT. My bike is on SORN but still insured.

T

The Yorkshireman

You may have noticed that all my info came from the DVLA site but as you can see from earlier posts, it is not so

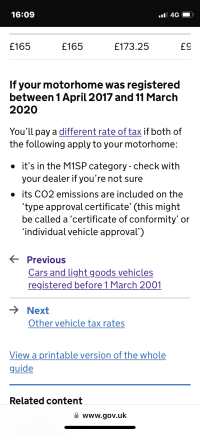

sorry I didn’t complete the post. I contacted the DVLC and it’s the type approval registered that determines the vehicle class; mine was registered as M1 when it should be N1 all be it a crafter 3.5t. If your vehicle was registered between 1st April 2017 and 11th March 2020 car or motorhome you will have to pay the extra over 40k tax. I fall just outside this so have asked the dealer to re register it. Not sure if VW will do it but thought it worth a shot.You may have noticed that all my info came from the DVLA site but as you can see from earlier posts, it is not so straightforward

Cheers

andyinluton

Super Poster

VIP Member

- Messages

- 7,741

- Vehicle

- T6.1 Ocean 204 4 motion

M1 is correct for all Californias, Grand or Regular. N1 is for commercial vehicles.mine was registered as M1 when it should be N1 all be it a crafter 3.5t. If your vehicle was registered between 1st April 2017 and 11th March 2020 car or motorhome you will have to pay the extra over 40k tax. I fall just outside this so have asked the dealer to re register it.

andyinluton

Super Poster

VIP Member

- Messages

- 7,741

- Vehicle

- T6.1 Ocean 204 4 motion

That's the standard £295 a year for PLG + the extra for paying in 12 instalments.All seems a bit random. Our 2020 Ocean just renewed at £309.75 for the year to Nov ‘23

WelshGas

Retired after 42 yrs and enjoying Life.

Super Poster

Lifetime VIP Member

All changed on 12th March 2020.M1 is correct for all Californias, Grand or Regular. N1 is for commercial vehicles.

Vehicle Excise Duty rates for motorhomes

andyinluton

Super Poster

VIP Member

- Messages

- 7,741

- Vehicle

- T6.1 Ocean 204 4 motion

From 12th March 2020All changed on 12th March 2020.

VED for new motorhomes will be aligned with the Light Goods Vehicle VED class M1SA vehicles are defined as motor caravans in Part A of Annex II to Directive 2007/46/EC. The minimum requirement is that a motor caravan includes seats and a table; sleeping accommodation; and cooking and storage facilities.

ie you will be charged same as PLG (£295 this year) and should be registered as M1 (unless you are a beach tour - then you are classed the same as a car, or a >3.5tnne GC then you are still M1 but PHG rates)

ColliePops

Lifetime VIP Member

I tax for the year and SORN accordingly as and when - works out a couple of quid cheaper than paying monthly - and easy to do on line.I pay monthly £27.56 which is a bit more than a one off payment but makes it easier to SORN it on the months I have no intention of using it.

S

Snowball1935

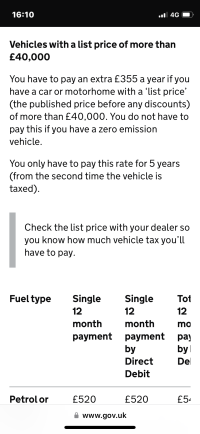

The surcharge on my 2017 VW Caravelle ends 30 April 2023. I believe that the surcharge has been increased by the DVLC, along with the inclusive emissions figure.

Basically, the whole issue of the surcharge on £40,000+ vehicles is nothing more than a government scam. I can only be applied because of the annual road tax renewal procedure, and is totally immoral. I have always been surprised that there has not been a general outburst of objections from the motoring organisations. The Fair Fuel lobby make a great deal of fuss over prices at the pump, but this tax surcharge is much more disgraceful and a misuse of government “clout”!

Basically, the whole issue of the surcharge on £40,000+ vehicles is nothing more than a government scam. I can only be applied because of the annual road tax renewal procedure, and is totally immoral. I have always been surprised that there has not been a general outburst of objections from the motoring organisations. The Fair Fuel lobby make a great deal of fuss over prices at the pump, but this tax surcharge is much more disgraceful and a misuse of government “clout”!

P

Pixcels

Lifetime VIP Member

I feel I agree with you.The surcharge on my 2017 VW Caravelle ends 30 April 2023. I believe that the surcharge has been increased by the DVLC, along with the inclusive emissions figure.

Basically, the whole issue of the surcharge on £40,000+ vehicles is nothing more than a government scam. I can only be applied because of the annual road tax renewal procedure, and is totally immoral. I have always been surprised that there has not been a general outburst of objections from the motoring organisations. The Fair Fuel lobby make a great deal of fuss over prices at the pump, but this tax surcharge is much more disgraceful and a misuse of government “clout”!

I'm all for supporting low vehicle emissions and the move away from carbon fuels but this does seem to be inequitable, and badly constructed legislation.

Another thing the ULEZ zone has just reached the end of my street, 50 yards away.

Fortunately our Cali is ULEZ compliant but my old Audi is not. So I can only now drive one direction down my home street without incurring a fine or a £15 er day charge !

Norfolk Jim

Finally retired at last.....................

Lifetime VIP Member

Not just Cali's that are confusing but also cars.

Just changing my wifes 13 Reg Golf 1.6tdi BMT with zero RFL and looking at a 17 Reg 1.6tdi BMT estate (both manual) and that is showing as £20 even though emissions are the same but then I found a 67 Reg estate (newer front - I think classed as Mk 7.5) and that's £165!!!!

Just changing my wifes 13 Reg Golf 1.6tdi BMT with zero RFL and looking at a 17 Reg 1.6tdi BMT estate (both manual) and that is showing as £20 even though emissions are the same but then I found a 67 Reg estate (newer front - I think classed as Mk 7.5) and that's £165!!!!

Ozzy Pete

The only reason I do it is because you are not waiting for the refund from the DVLA. As long as you cancel on the last day of the month and cancel the DD payment as well as the SORN.I tax for the year and SORN accordingly as and when - works out a couple of quid cheaper than paying monthly - and easy to do on line.

Red wine lover

Hi there Jeff, is it possible that you can send me a copy of page 2 of the v5 logbook as I got nowhere with VW and do need to sort out this problem.Interesting: I too have a 2008 2.5 auto. I remember that, at the time, they were registered in the UK as some sort of commercial vehicle, and the tax was very high. But a challenge was made by owners (supported by VW) , and the UK Government agreed to change it to PLG. This made a huge difference. My last tax bill ( just 2 months ago) was £295 for the year.

[email protected]

Similar threads

H

- Replies

- 4

- Views

- 2K

- Replies

- 20

- Views

- 5K

- Replies

- 0

- Views

- 1K

About us

The VW California Club is the worlds largest resource for all owners and enthusiasts of VW California campervans.