P

Pixcels

Lifetime VIP Member

I'm still confused and after reading earlier posts on the subject I feel even more confused.

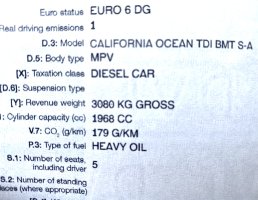

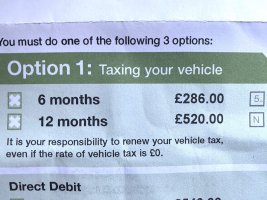

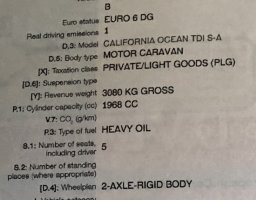

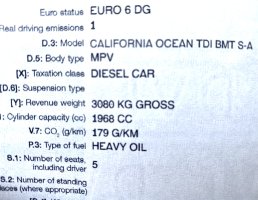

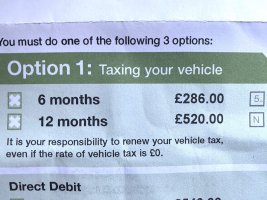

We have received our latest reminder to tax our 2019 California and it comes in at £520, which is pretty eye watering but maybe correct.

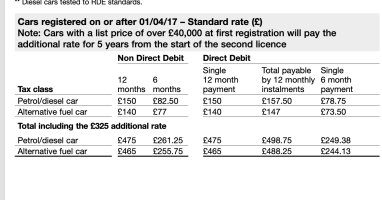

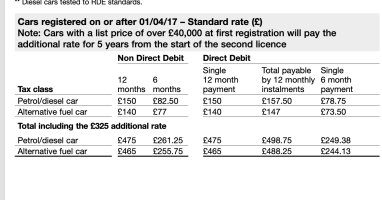

However according to the Govt guidelines (V149) we should be paying £475 but after that I got a bit lost ...

Anyone with a definitive view ?

We have received our latest reminder to tax our 2019 California and it comes in at £520, which is pretty eye watering but maybe correct.

However according to the Govt guidelines (V149) we should be paying £475 but after that I got a bit lost ...

Anyone with a definitive view ?