66tim99

Super Poster

Lifetime VIP Member

I enclose the LV Campervan Policy Document. Following your extensive conversation with a Senior LV Manager would you be so kind as to point out which section covers damage to the vehicle whilst camping, in particular kitchen fire whilst cooking or storm damage to the roof mechanism or attached awning etc:

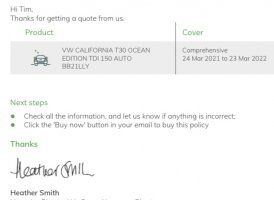

Accidental damage. I’ve got a great quote from LV and intend to insure my ocean with them when it finally arrives. I spoke to them about the lack of camper-specific words (after being alerted by you WG I think - thanks) and they explained roof, awning, fire are all accidental damage. She verified it with the claims department. Stealing the van via the pop up roof would be vandalism. “Yes we do know we’re insuring a campervan” she said, it says so on the quote. All our calls are recorded and we can trace it back, as we know when we’ve spoken to you.