WelshGas

Retired after 42 yrs and enjoying Life.

Super Poster

Lifetime VIP Member

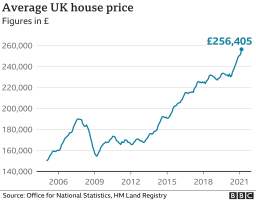

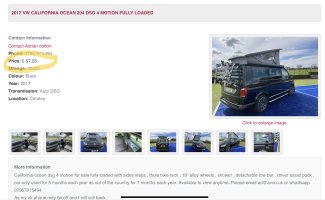

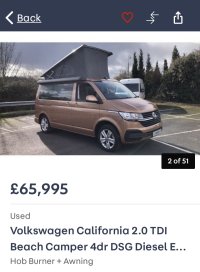

Very few people are probably spending £75k cash on a California. In line with most new auto sales they maybe using PCPs to finance the deal especially if they are not embracing the lifestyle wholeheartedly and using it as a stop gap until normality returns.You've made some valid points that I agree with but you haven't necessarily referenced the target market for new Californias I don't think. What kind of person is spending £75K on a Cali instead of £55k on a conversion. What type of person is spending an extra £20K to get something just as good but with a VW badge?

I would argue that the answer is an older wealthy person, someone who is not necessarily affected by the cost of living crisis, Putin's awful, awful invasion or other global factors. As such their purchase is a lifestyle choice, not an economic one.

This generation who have the money to spend, are more likely to know what they want and buy it regardless, before their knees give way.

The prices may fall, but not necessarily for Calis alone. It will start at the bottom of the price bracket I think and work its way up!