I think I’ll be going down the Vodafone S5 and free insurance route. Two things have swayed me recently.

Firstly, a friend has a T5.1 Cali with the Vodafone tracker on it and has no issues with the unit or the app. They seem very happy with it. Unfortunate that you’ve encountered issues Kennisted but it sounds like you’ve been unlucky.

Secondly, I’ve just tried Comfort Insurance and they won’t insure me as I park on the road (value too high for on road parking).

I think at renewal, I’ll have a better chance of getting a number of decent quotes to choose from with a tracker so I may as well get one subsidised by the free VW Insurance for a year.

Coincidentally, a couple of people on the FB page have intimated they have had issues with VW and them making it awkward to take out the free insurance (currently awaiting further details from them as they were unsubstantiated comments). How have other people found VW to deal with regarding the free insurance?

I think I’ll be going down the Vodafone S5 and free insurance route. Two things have swayed me recently.

Firstly, a friend has a T5.1 Cali with the Vodafone tracker on it and has no issues with the unit or the app. They seem very happy with it. Unfortunate that you’ve encountered issues Kennisted but it sounds like you’ve been unlucky.

Secondly, I’ve just tried Comfort Insurance and they won’t insure me as I park on the road (value too high for on road parking).

I think at renewal, I’ll have a better chance of getting a number of decent quotes to choose from with a tracker so I may as well get one subsidised by the free VW Insurance for a year.

Coincidentally, a couple of people on the FB page have intimated they have had issues with VW and them making it awkward to take out the free insurance (currently awaiting further details from them as they were unsubstantiated comments). How have other people found VW to deal with regarding the free insurance?

Got our new Ocean last week and used the VW free insurance. My theory was same as yours in that May as well spend the £550 to get it fitted in lieu of the first year’s premium as will invariably need it for subsequent renewals.

Found the VW promotional material a bit misleading in that it simply said “may need security device fitted” it didn’t say it “has to have a £550 tracker”.

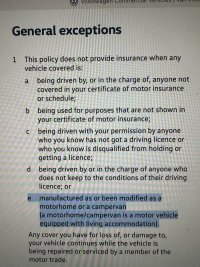

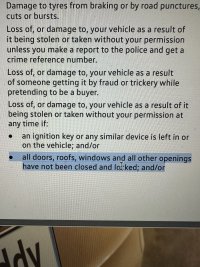

There are various restrictions which do restrict availability of the policy. Some of which I suppose I can understand, but others feel a bit stingy. I don’t think I can remember them all but your dealer should give you a sheet with the details on that you then need phone through to VW Insurance. Thus included :-

- have to arrange the insurance before vehicle collection, they suggested 48 hrs. So what that means is you have to have the tracker fitted at the dealers before you collect it, and you can’t take it elsewhere to get fitted.

- minimum age was I think 21

- uk driving licence, I think needed be held minimum 2 years

- no claims in last 2 years - this caught us out as my wife has an unresolved claim from 18 months ago (hit by a 3rd party but both cars insured with Direct Line and the other party disputes it was her that hit my wife, and DL have just sat on it) So we have not been able to add her to the policy as couldn’t get DL to make a decision in the few days we had to resolve it. Can’t add her or anybody to the policy after the event so that’s quite a material restriction as will need pay to add her and unclear if that’s effectively full premium

- no driving convictions, think it said they would allow one minor one

- to be fair the guy on the phone was quite helpful, but it’s very black and white if you qualify or not

- if you need business usage for driving to meetings etc it included that

- stupidly the one thing I forgot to ask about was adding European trips !

- still awaiting the full policy booklet so that will clarify a few things when it arrives

but ultimately took the view they had me over a barrel having had the tracker installed that I may as well take the free policy for now and if it’s cheaper to move providers to add the wife later then we will have to.

the Vodafone app works fine I have found. It doesn’t have lots of features but then again it’s a tracker so not sure what else it might do.

so overall some pluses and minuses but in the long run looks like need a tracker whatever, and maybe naively I think of all the insurers VW will have a hard time saying they don’t know what a California is if we ever needed make a claim for anything not driving related.