G

GrumpyGranddad

Guest User

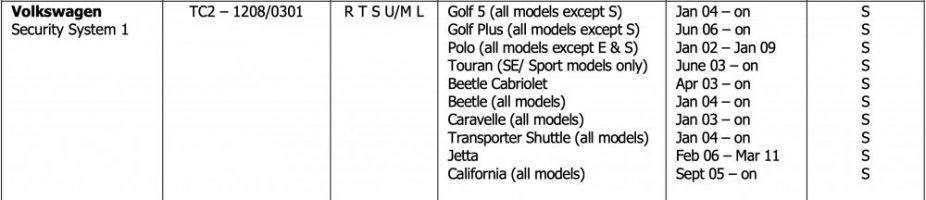

I think the important thing is that it is a factory fitted Thatcham Cat.1 approved alarm/immobiliser.Me again sorry.... I have been in contact with C&MC and they have asked me to find out what make and model the immobiliser is. I have stated that it is factory fitted, does anyone have any more detail about which immobiliser is fitted? TIA

I think the important thing is that it is a factory fitted Thatcham Cat.1 approved alarm/immobiliser.