66tim99

Super Poster

Lifetime VIP Member

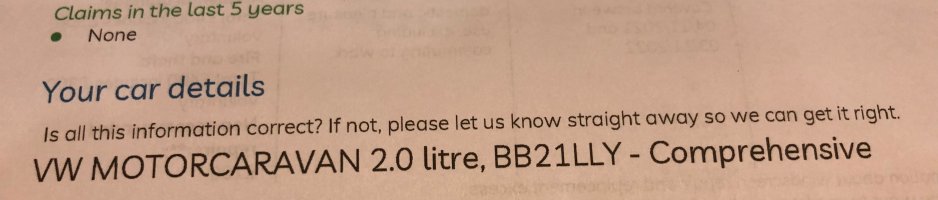

They know what they are insuring but the cover is lacking in serveral ways, particularly if you have a new van which you managed to negotiate a good discount on.

They’ll replace it with a new vehicle if less than a year old. If there isn’t one available they’ll pay the price you paid. Sounds like a reasonable balance, recognising that in that circumstance the payment isn’t going to get me a new vehicle (there’s always a chance of a dealer having a new one availableThey know what they are insuring but the cover is lacking in serveral ways, particularly if you have a new van which you managed to negotiate a good discount on.

though), but also that it’s unlikely to happen. I’m sure I could pay double the premium and have new for old for 2 years, or manufacturers list price, but in the unlikely event of it happening, I’d be ok with getting my money back. You can arm yourself to the teeth with insurance and haemorrhage cash monthly, or strike a balance.

In what other ways is it lacking?